Be Positive... But Vigilant

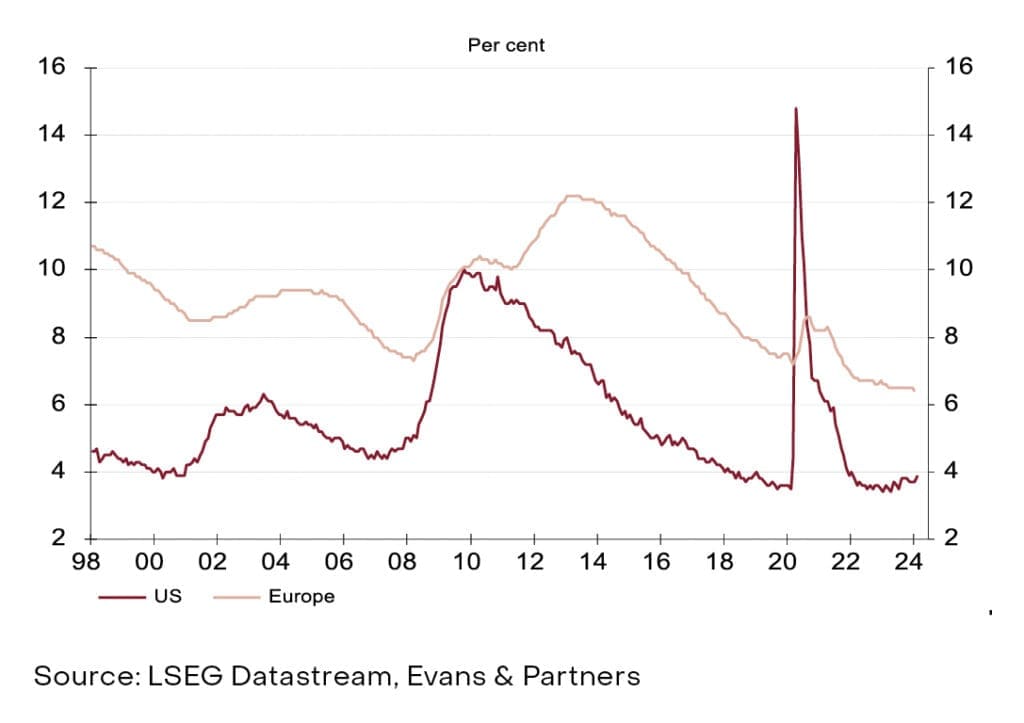

Across the globe, economic conditions continue to surprise to the upside. Most markets have absorbed rapidly rising interest rates without any major disruption or dislocation and look poised for continued growth. While we’re positive on the near-term outlook, we outline some lingering risks that investors should bear in mind.

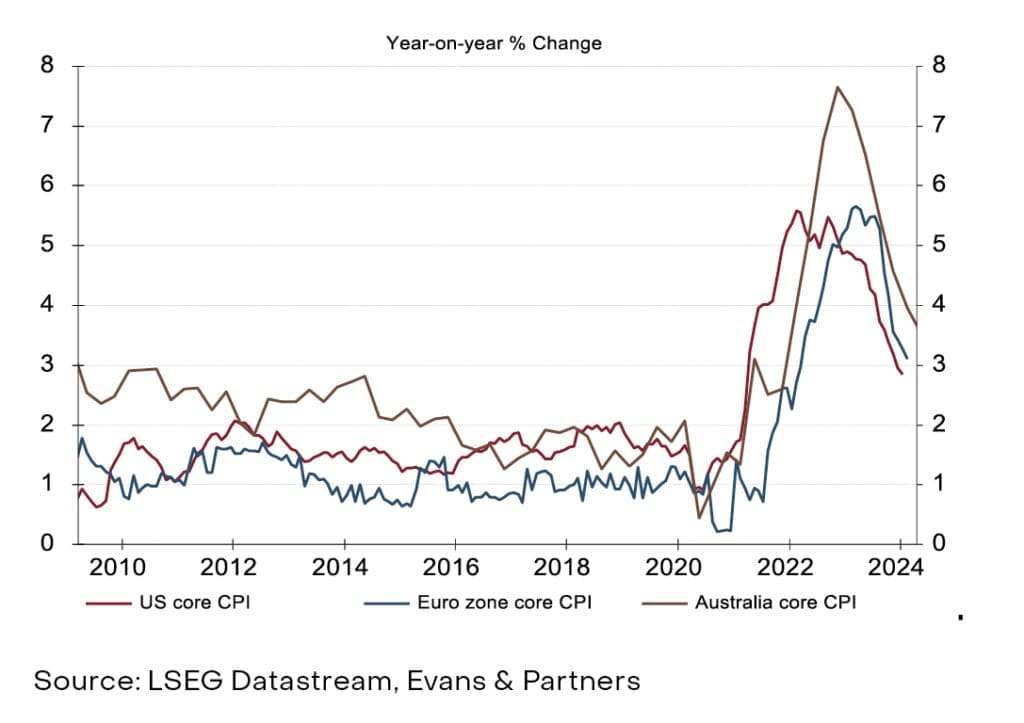

The global outlook is more positive than it has been in some years. The inflation threat has mostly passed and higher interest rates have not resulted in the recessions that were predicted for most western economies.

Positive drivers

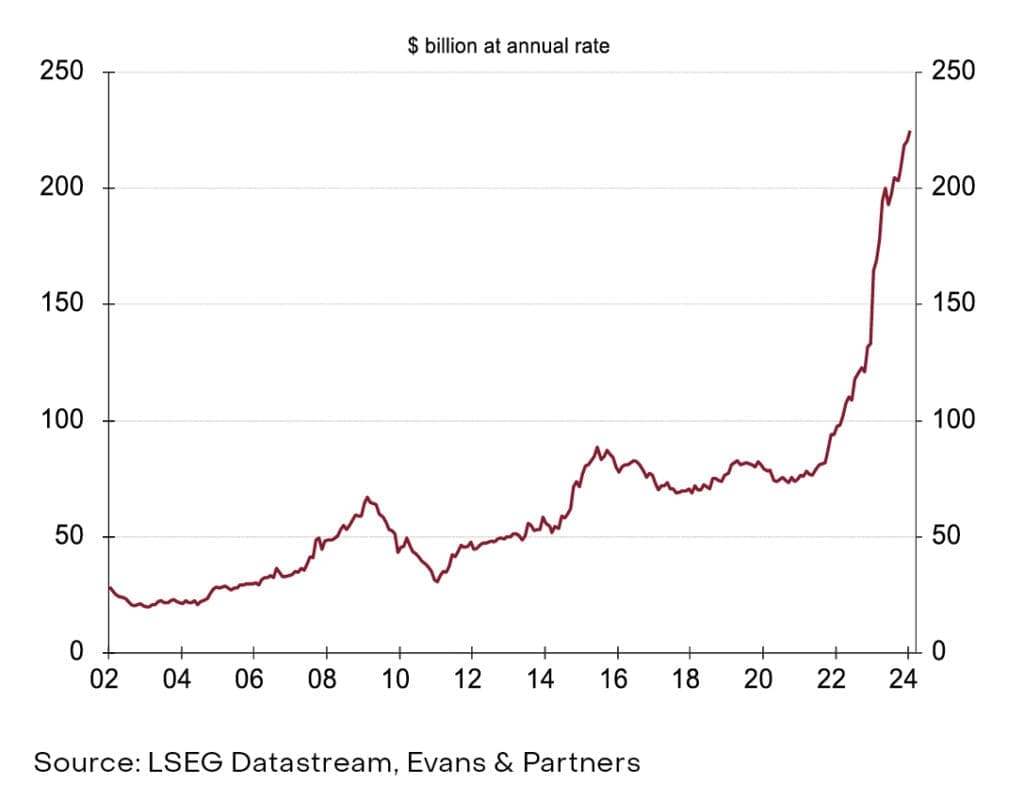

The drivers of activity are households spending the savings they had accumulated during the COVID years and a new wave of construction linked to clean energy transition and manufacturing reshoring. The Chinese economy has stabilised and other developing economies are performing well.

Lingering issues

We need to be vigilant on a few issues though: lingering wage and price inflation in the US, pockets of financial distress including the US commercial property market, heightened political risk in the Middle East and the US presidential election later this year.

Domestic strength

In Australia, the local economy has also held up much better than many expected as it has been boosted by healthy consumer balance sheets and a surge in immigration. A strong labour market has allowed workers to work more hours and take on second jobs to cope with higher interest rates. Going forward, the huge savings pool points to more strength in consumption once interest rates start to fall and confidence returns.

Stretched valuations

Less good news for investors from here is that equity markets have now priced in this better outlook quite aggressively. The US market has risen by around 25% since October and this has dragged other markets higher. Around 9 million US households have bought shares for the first time using excess savings and this has benefited the biggest US tech companies – those that are household names – the most. This is now starting to spill over into other parts of the equity market and speculative assets like bitcoin. Much excess cash remains so it is possible that this will continue to play out.

We still see opportunities in markets:

- Smaller companies and emerging markets have lagged and are normally major beneficiaries of improving economies.

- The jump in interest rates has lifted returns in interest rate securities so investors should look to add to their holdings in this asset class.

Unemployment Rate

Major Region Core Inflation (CPI)

US Manufacturing Construction Investment

Tags

Important Disclosures

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information provided is correct at the time of writing or recording and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained.

Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.