Bringing Forward, Looking Ahead: Contributing More to Super

For Australians looking to build their retirement nest egg, non-concessional contributions offer a way to make larger deposits into superannuation over a shorter period. Understanding the bring-forward arrangement can enhance this strategy by allowing individuals to triple their annual contribution cap. Current market volatility may also create opportunities for individuals who were previously ineligible to contribute to superannuation to requalify.

What are non-concessional contributions?

Non-concessional contributions are after-tax contributions made to a superannuation fund. These contributions are typically sourced from income that has already been taxed at the individual level and therefore is not taxed again when received by the fund. Common examples of non-concessional contributions include:

- Personal contributions for which no tax deduction is claimed (e.g. deposits from a personal bank account)

- Contributions made on behalf of a spouse (these are treated as non-concessional for the receiving spouse)

- Excess or disallowed concessional contributions, where the individual elects not to withdraw the excess from their superannuation fund

Non-concessional contributions are subject to two key eligibility requirements. Individuals must be under the age of 751 and have a total superannuation balance of less than $1.9 million as at 30 June 2024 to make a contribution in the 2024-25 financial year. The non-concessional contribution cap for the current financial year is $120,000. However, eligible individuals may be able to contribute more through the bring-forward arrangement.

How the bring-forward arrangement works

The bring-forward arrangement allows eligible individuals to access up to three years’ worth of annual non-concessional contribution caps in advance. This can be particularly useful for those who have received an inheritance, sold an asset, or otherwise have a significant sum they wish to contribute to superannuation.

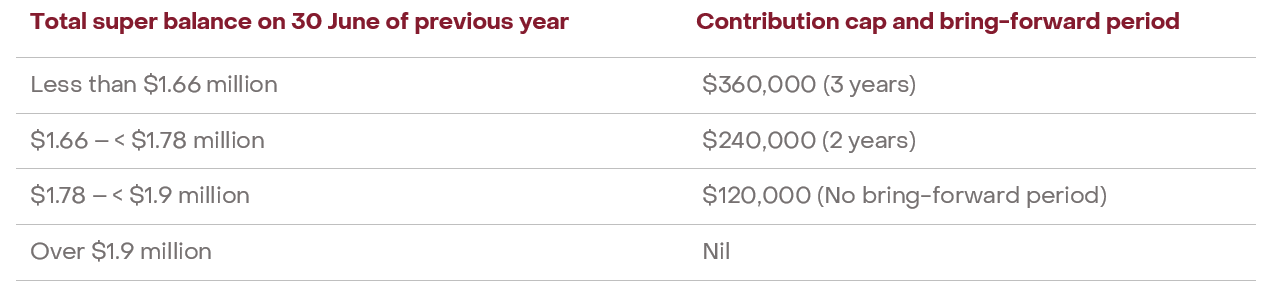

To use the bring-forward rule, similar age and total superannuation balance requirements apply. Individuals must be under age 751 at the start of the financial year in which the bring-forward arrangement is triggered. To utilise the full three-year cap, an individual’s total superannuation balance must be below $1.66 million, with the entitlement reducing progressively as outlined below.

Opportunities amidst market volatility

Current market conditions have suppressed superannuation balances for many. However, they may also present an opportunity for certain individuals to top up their superannuation in the coming months. Eligibility for non-concessional contributions and the bring-forward arrangement is tied to an individual’s total superannuation balance as at 30 June of the previous financial year. As we approach 30 June 2025, individuals whose balances have declined due to market movements or withdrawals may find themselves below the relevant thresholds. This presents a unique opportunity for those currently ineligible to once again contribute to superannuation from 1 July 2025.

This window of opportunity can also align with other financial planning strategies, such as a withdrawal and re-contribution. As the name suggests, this involves withdrawing funds from superannuation and contributing them back into the fund. While this may seem ineffective, the strategy can increase the proportion of your fund that is considered tax-free and thus improve estate planning outcomes for certain beneficiaries. A more detailed overview is available here.

How a contribution can benefit you

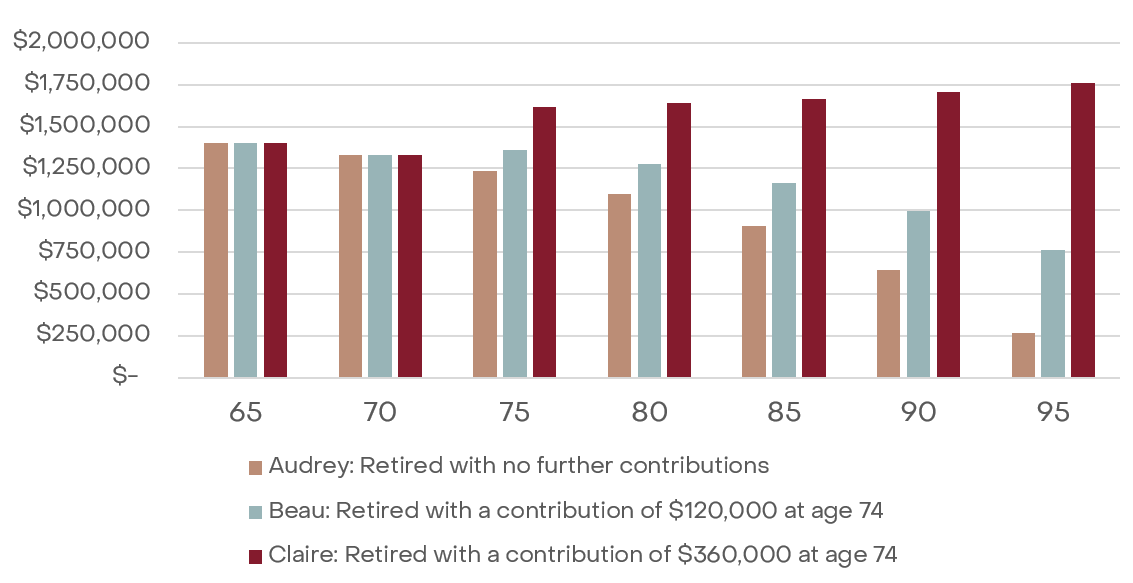

For those looking to preserve or continue growing their superannuation balance in retirement, making a contribution can be an effective strategy. In the example below, we consider three retirees—Audrey, Beau, and Claire—each aged 65 and intending to withdraw $110,000 annually to fund their retirement lifestyle.

Audrey begins retirement with a superannuation balance of $1.4 million and gradually draws down on this over time. Beau takes a similar approach but finds that, after 10 years, he has accumulated excess cash in his bank account. He decides to make a non-concessional contribution of $120,000 back into superannuation. By age 95, Beau has approximately $500,000 more in savings than Audrey.

Claire, on the other hand, chooses to sell her investment property and uses the bring-forward arrangement to contribute $360,000 to her superannuation. This allows her to not only preserve but grow her super balance over time. By age 95, Claire has built up over $1 million in additional savings compared to Beau.

Source: E&P

Please note, the above graph is for illustrative purposes only and does not constitute advice. The actual outcome will vary based on market movements, fees, insurance premiums, tax paid, and your relevant personal circumstances. The 7% return used in this example is not applicable to all investment returns. Individual performance may also differ due to timing of transactions or investment size of holdings.

Overview

Non-concessional contributions and the bring-forward arrangement can help individuals build their retirement nest egg and increase the proportion of their wealth held within the tax-effective superannuation environment. It is important to note exceeding the non-concessional contribution cap can attract additional taxes and the administrative process to resolve this can be protracted. An Evans and Partners financial adviser can assess your eligibility, assist in maximising your contributions, and integrate this strategy within a broader financial plan.

Note1: Non-concessional contributions can generally only be accepted by a super fund no later than 28 days after the end of the month in which the person turns age 75. This must be checked with the relevant fund before making a non-concessional contribution.

Tags

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.