Caution Warranted

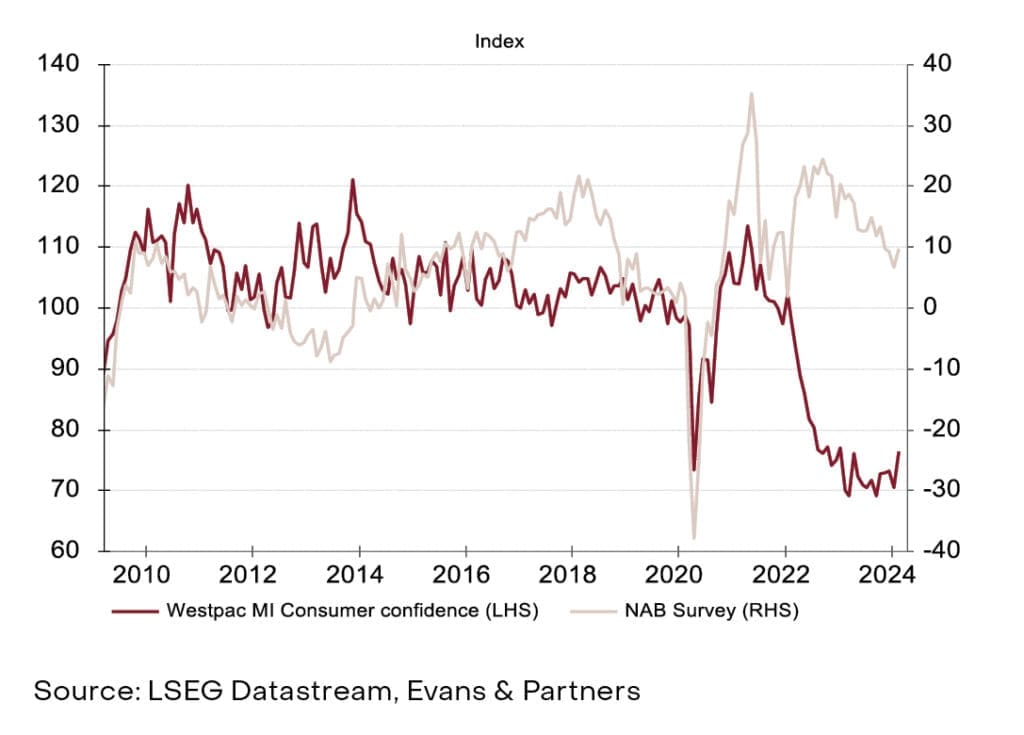

The Australian economy is holding up far better than expected given higher interest rates. There has been some slowing but far less than most economists feared.

There were major concerns for the consumer given that one third of households have mortgages. However, it appears that excess savings accumulated during the COVID years has limited the damage and there have been offsets from other areas such as immigration and a wave of construction spending.

Risks remain

These risks have not completely abated. Inflation rates have fallen but there is still plenty of inflation pressure in the pipeline from electricity, rents and insurance. The labour market also remains tight and we are yet to see the full flow-through of large rises in awards, minimum wages and some public sector agreements.

Construction and capex

While the short term is uncertain, Australia is well positioned for medium term expansion. The next global cycle appears set to be dominated by major capex programs in the energy infrastructure, healthcare and manufacturing sectors. This should provide strong support for commodity demand. We are also in the early stages of a local construction wave driven by the Brisbane Olympics, a second Sydney airport, major road and rail projects and a rebuilding of the electricity network to accommodate the adoption of renewable energy.

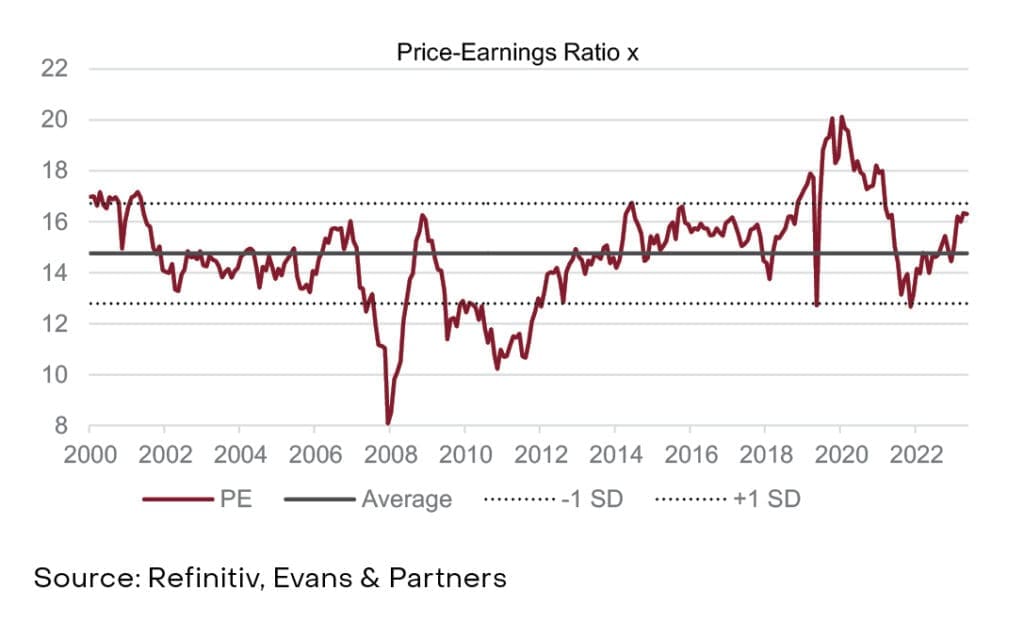

Stretched valuations

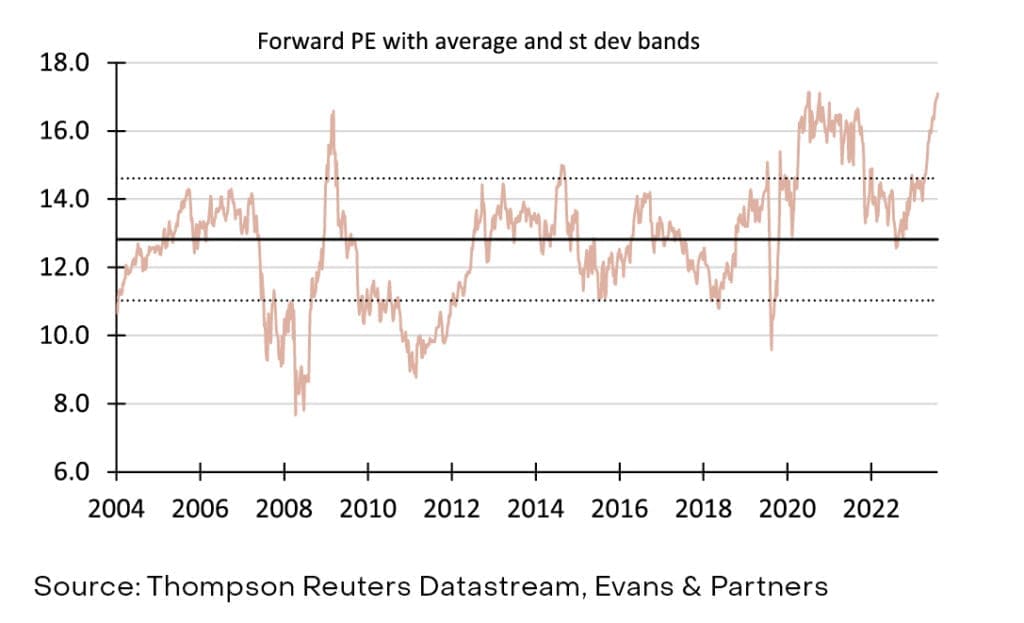

The Australian equity market has followed the US market higher in recent months and valuations now appear stretched. Banks and blue-chip company valuations are back near record highs. The recent reporting season showed a divergence in outcomes by sector. Pricing power, cost control and a resilient economy allowed many industrial companies to beat earnings expectations. However resource companies reported cost overruns and were hurt by falls in some commodity prices.

Banks are one area where caution is warranted. They have performed well because of strong dividends and expanding margins. But margins will soon peak as deposit rates rise, the cost of other funding increases and they compete more aggressively for new business. There is also still the risk of credit deterioration as higher interest rates eat away at borrowers.

For resources, there are some short term concerns as key commodity prices remain weak. This is particularly the case for iron ore. However energy and gold prices are rising and stock prices have lagged for producers of these commodities. Energy stocks are also a good hedge against geopolitical risk.

REITs have lagged the market as investors remain concerned about asset values and the delayed impact of higher rates. These fears appear to be overdone in some parts of the market. Retail REITs in particular are trading at large discounts to underlying values even though the outlook for the sector has stabilised.

Australian Business vs Consumer Confidence

ASX 200 Valuation

Price to Earnings (PE) Ratios for Australian Major Banks

Tags

Important Disclosures

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information provided is correct at the time of writing or recording and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained.

Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.