China’s Rapid Reopening: What It Means for Investors

Within weeks of China lifting its contentious zero Covid restrictions, the virus spread extremely quickly. Surveys suggested 70-80% of major city residents believe they have already been infected.

Shortly after, the spike in subway users suggested that most residents are returning to pre-Covid work, spending and travel habits.

The implications of this return to normal is expected to be significant. And if the economic changes follow the pattern of China’s Covid transmissions, they will be swift. This is likely to have a substantial impact for investors.

Chinese spending spree

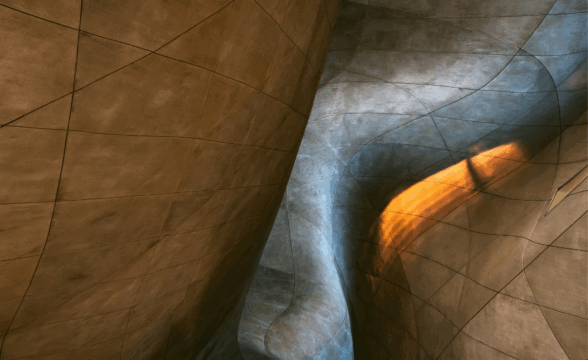

Similar to the Australian experience, Chinese households saved substantially more than they spent during lockdown. Estimates show that Chinese households accumulated around $US 1 trillion in excess savings over the past two years. Covid restrictions had a profound effect on retail, with spending falling to 17% below trend.

If Chinese consumers follow the same pattern as the West and engage in ‘revenge spending’, the impact on the Chinese and global economy will be profound.

Chinese assets: under-owned and undervalued

Chinese assets are trading at distressed levels. Even after the 50% rally since November, the PE for the Hong Kong-listed China shares is still below 6x. Importantly, higher regulatory and political risks also played a significant role in the China’s market’s collapse; however, these have eased substantially in recent months.

Beijing is no longer targeting the big technology companies, and the US SEC is no longer threatening to delist Chinese companies from US bourses.

Based on adverse political developments, many offshore investors had concluded that China had become ‘uninvestable’ and cut their holdings to zero. Given the scale of the current rally, though, these same investors will be forced to buy back. China is now a large part of global markets (27% of emerging markets and 3% of global markets) and it is too risky for benchmark-aware investors to avoid the Chinese market entirely.

Chinese tech companies should particularly benefit since they were most affected by the regulations. Currently, they are trading at a 30% discount on their US equivalents.

Chinese tourism

The return of Chinese tourism will have a significant impact on the global economy.

In 2019, China represented 17% of the total aviation market, so its absence left a considerable hole. Global air travel has now returned to 75% of pre-Covid levels. Asian travel is still behind, currently, with only 50% of pre-Covid levels.

However, Chinese travel is likely to ramp up and lead to a second wave of recovery in tourism. And this spike presents a range of positive implications:

- This travel will boost the economies of Japan and ASEAN. Thailand and Japan hosted the most Chinese visitors in 2019, with 11 and 10 million tourists, respectively.

- Australia will be a major recipient of Chinese tourists. In 2019, China was the largest source of Aussie arrivals at 1.3 million. Their gradual return will add to recoveries already underway for the airlines and other travel companies.

- Luxury goods should also gain, particularly European brands. Before the pandemic, more than half of Chinese spending on luxury goods was offshore.

Energy and commodities

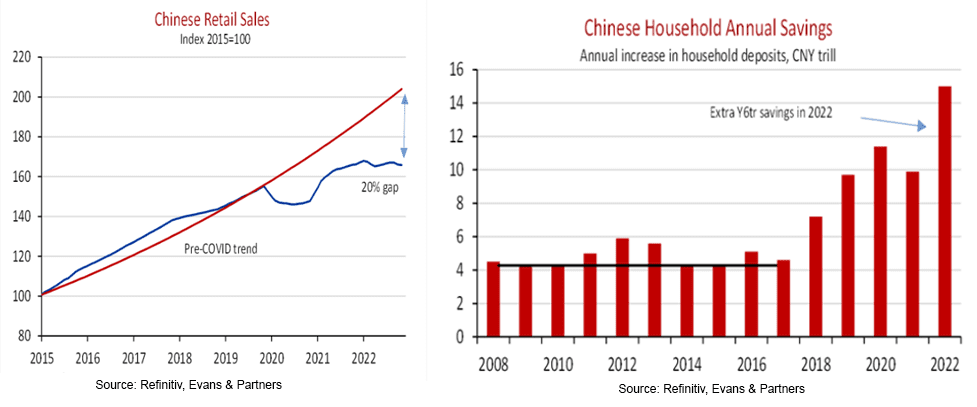

The most significant commodity price impact will be on oil prices. Due to a downturn in air and land travel, Chinese crude petroleum imports are over 20% below normal levels. We expect this downturn will bounce back hard — the oil market is already tight, evidenced by record-low inventories.

A range of other commodities will also benefit — copper and iron ore prices have also risen.

Broader implications

Such dramatic change in the world’s second-largest economy will have more far-reaching implications. Near-term recessions are less likely, but it complicates matters for the Fed — particularly if it sparks a second wave of inflation due to a direct impact on oil prices (along with other indirect effects).

Essentially, the Fed needs the US economy to slow to ease pressure in its labour market — and it’s been relying on a deteriorating global economy to help achieve this.

There will also be implications for other asset classes:

- Major currency moves are already underway and could be a strong theme for 2023. The USD is rapidly weakening, pushing up the Yen, Euro and AUD. There is potential for more upside in the AUD, so investors should keep higher than normal hedging levels for offshore investments.

- This change is probably not favorable for bonds. Yields are now low again (US 10 year at 3.5-4%), and if the Fed has to keep tightening, then long-term rates could head higher.

- For equity markets, China and emerging markets stand out. Meanwhile, Europe will benefit from a tailwind from China and a rising Euro. Conversely, we hold greater concerns for the US as further interest rates may affect them more substantially.

If you’d like to discuss the implications of China’s recent events and determine if any options suit you, please speak to your adviser.

Tags

Disclaimer

This information was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group).

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. E&P Financial Group, its related entities, officers, employees, agents, advisors nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.