Emerging Markets and Small Companies Stand Out

Equities have experienced remarkably strong returns since October 2023 when investors started to consider interest rate cuts by the US Federal Reserve.

Households have had excess savings since COVID and these are now being put to work more aggressively. Large US tech companies have been disproportionate winners. There have been some other areas of strength (Japan, India) and some laggards (emerging markets and smaller companies).

Rebalancing focus

Our strategy from here is to reduce weights to areas where gains have been strong and valuations are now stretched. There are a number of risks that could affect sentiment in the second half of the year. This includes some lingering inflation pressure, concerns about commercial property valuations and political uncertainty heading into the US presidential election. At the same time, there are some areas where valuations are not stretched and could benefit from ongoing high liquidity levels and resilience in the global economy.

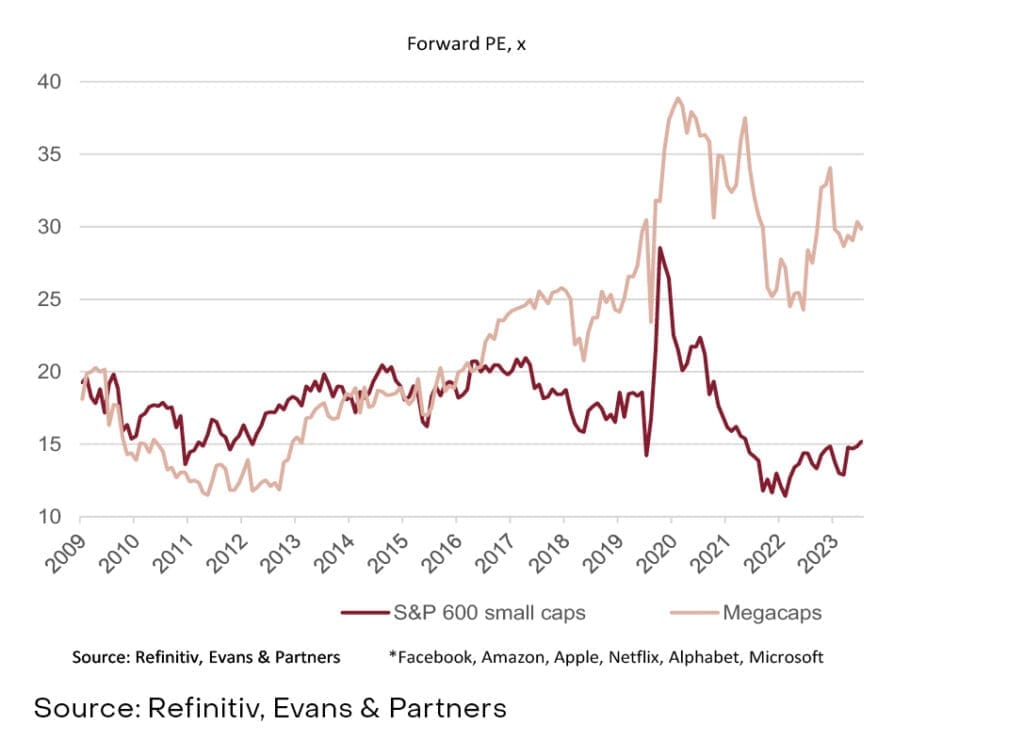

Small caps less stretched

The US has the most stretched valuations and is now the most vulnerable to correction as interest rate concerns re-emerge. This is particularly the case for the big tech stocks that rode the AI wave to extreme valuations. Our preference is for smaller companies only. They have not seen the same valuation rerating as the mega-caps.

Emerging standout

Emerging markets are the standout global region for now. All eyes have been on China where the post-COVID recovery has disappointed. Consumer confidence is weak due to concerns over the property sector. However, a range of stimulus measures have been announced and these are starting to have an impact. Other emerging markets also have good prospects. Taiwan and Korea will be large winners from AI equipment while Mexico and south Asia are beneficiaries of manufacturing relocation.

A tale of two halves

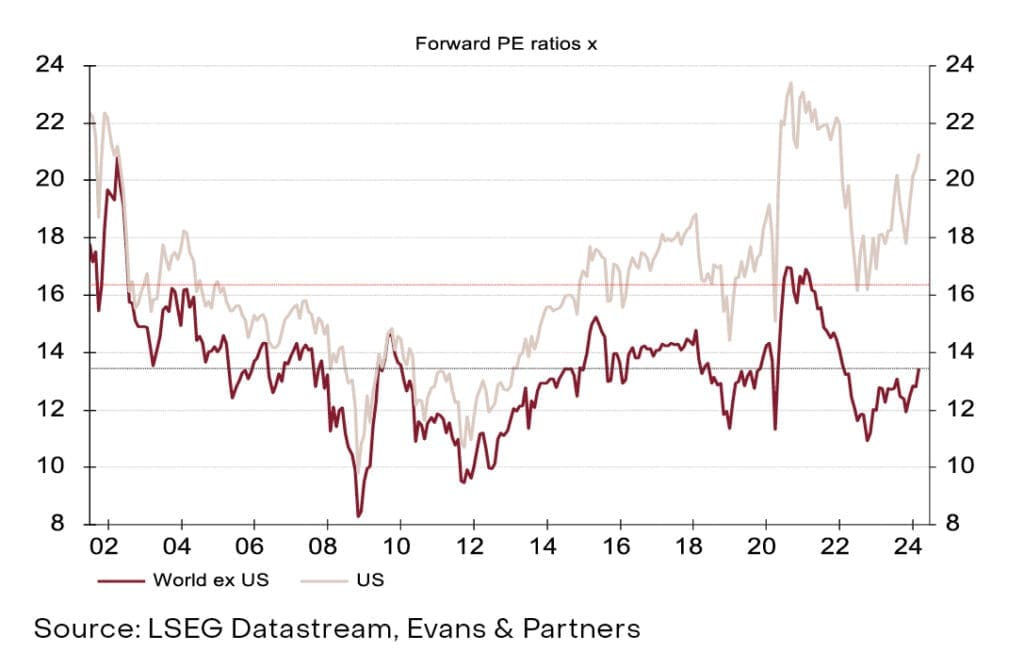

Europe is facing more challenges. The industrial north is suffering from a manufacturing recession but this has been offset by the benefit of returning tourism to the southern nations. In the short term there are still risks from energy shortages and rising interest rates. We do not recommend increasing exposure to Europe at this time but we will be monitoring the situation as its equity markets are not expensive.

Currency concerns

Equity investors need to be more aware of the potential for currencies to drive relative performance going forward. It has been a remarkable run for the $US over the past decade driven by US corporate dominance and structural challenges in Europe. This has left the currency overextended and vulnerable to reversal over the next cycle.

US Valuations by Size

US and World ex US Valuations

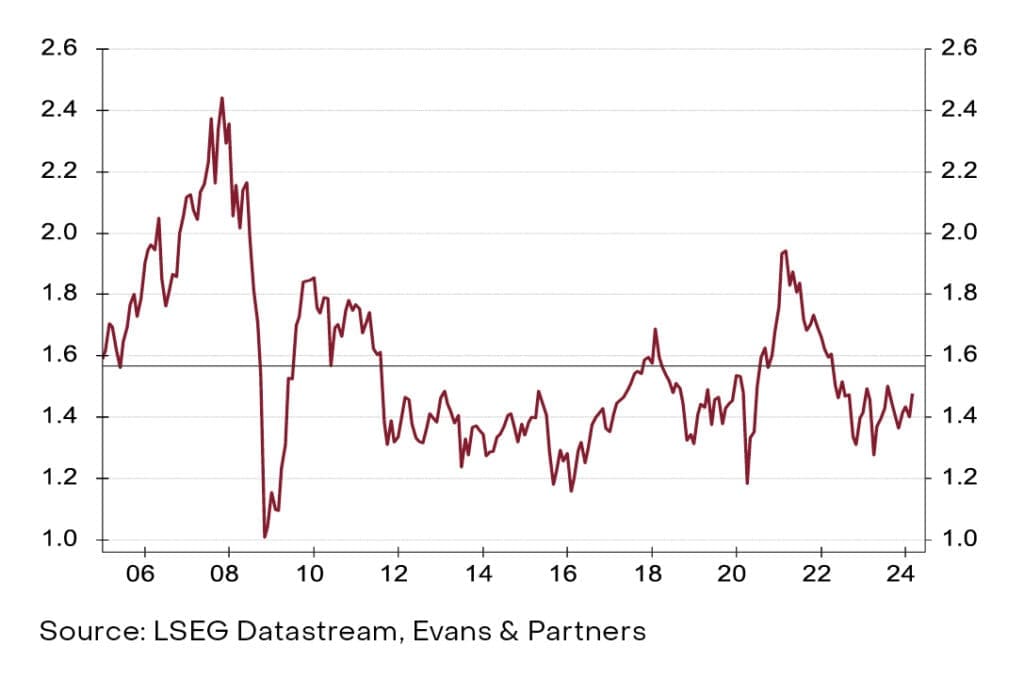

Emerging Markets Price/Book

Tags

Important Disclosures

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information provided is correct at the time of writing or recording and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained.

Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.