Differentiating A Bear Market From A Market Correction

In the jargon of financial markets a “correction” in a stock index is defined as a fall of 10 per cent and a “bear market” is a fall of 20 per cent. This correction is measured from the most recent peak in the market.

Historical context

Corrections are relatively common but bear markets generally only occur in a recession. For the Australian market there has been an intra-year fall of 10 per cent or more in 21 of the last 28 years.

In 13 of those years, the ASX 200 still finished higher for the year.

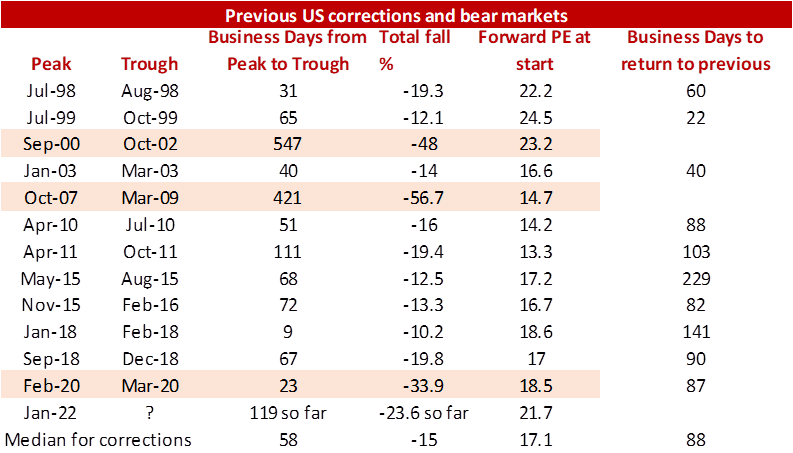

The United States has seen a slightly smaller number of corrections. There have been 12 corrections in the US in the past 22 years. The typical correction is around 15 per cent and lasts for 58 trading days.

In most cases they have returned to previous levels reasonably quickly.

Causes of corrections

Corrections have a range of causes. They can often reflect over-reactions to events such as political or macroeconomic events, and markets tend to recover once it becomes clear that the impact of the event is not going to be significant.

Generally a correction has not become a bear market unless there has been a recession. The three US bear markets of the past 20 years correspond to the three recessions during that period i.e.,

- The 2001-03 recession

- The global financial crisis (GFC)

- The COVID-19 crisis.

In considering whether the current selloff will become a “bear market”, and the severity of that bear market, the main question is the possibility of recession. To assess this we consider such issues as:

- the implications of rising interest rates,

- the prospects for financial system stress, given debt levels have increased in recent years.

Tips for navigating a bear market

While market corrections and bear markets can be distressing for investors, often the worst mistake that investors can make is selling stocks after a big fall. This increases the chance of a permanent loss of capital.

Even during the GFC, investors who stayed the course i.e. retained their equity holdings, recouped their losses within a few years. Additionally, investors who sold out of their holdings after the collapse of Lehman Brothers would not have been able to recoup those losses in other asset classes.

As always, stay close to your adviser.

Tags

Disclaimer

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiaries of E&P Financial Group Limited (ABN 54 60 9913 457) (E&P Financial Group) and related bodies corporate.

This communication is not intended to be a research report (as defined in ASIC Regulatory Guides 79 and 264). Any express or implicit opinion or recommendation about a named or readily identifiable investment product is merely a restatement, summary or extract of another research report that has already been broadly distributed. You may obtain a copy of the original research report from your adviser.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. E&P Financial Group, its related entities, officers, employees, agents, advisors nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.evansandpartners.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.