What is inflation and why it matters

Inflation is an increase in the level of prices of the goods and services that households buy. It is measured as the rate of change of the prices within the consumer price index, i.e., a specific ‘basket’ of goods and services weighted by spending patterns in the economy.

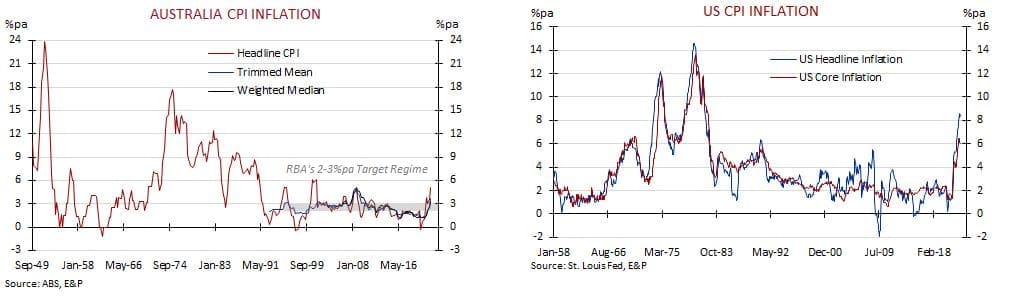

Typically, prices rise over time, but prices can also fall. This is called “deflation” and was the risk central banks were grappling with in the period prior to the COVID-19 pandemic. However, we are now in a different environment, with inflation running at multi-decade highs.

Understanding the drivers of inflation

For policymakers, what is driving inflation ― and the likelihood of its persistence ― matters. That is why understanding the different types of inflation is important.

The main types of inflation are:

- Demand-pull inflation. This occurs when activity is strong and demand for goods and services outpaces the ability of an economy to increase its production capacity.

- Cost-push inflation. This is the result of a jump in input prices working through the production process. A large lift in oil or a one-off tax hike are examples. Policymakers usually look-through and don’t respond to these external inflation shocks as they aren’t expected to last.

- Built-in inflation. This is also known as a wage-price spiral. This occurs when the cost of living rises, and in response, workers demand higher wages. To offset their higher costs businesses then raise their prices, leading to a self-reinforcing loop.

The current environment

There are elements of each of these different inflation types now at work. Since the onset of the COVID-19 pandemic, the mix of strong demand ― on the back of the enormous amount of policy support provided ― and rolling supply disruptions has seen inflation surge.

In addition to promoting ‘full employment’, central banks have a ‘price stability’ mandate which is aimed at controlling the rate of inflation:

- In Australia, the Reserve Bank targets 2-3 per cent inflation on average over time

- In the United States, the Federal Reserve targets 2 per cent per annum inflation.

Over the medium-term, price stability ― or a relatively constant level of inflation ― is a fundamental macroeconomic pillar that helps preserves the value of money and should lead to relatively more stable growth as it gives businesses and consumers confidence to plan for the future.

What are the risks for prolonged periods of inflation?

Prolonged high inflation is problematic as it erodes consumers’ purchasing power. This is a particular issue for lower income households as inflation is a ‘regressive tax’. High inflation also distorts spending and investment decisions, and it can lead to a self-fulfilling change in consumer and business price-setting behaviours that can become embedded

Factors to consider in the outlook ahead

After keeping policy settings too loose for too long, global central banks are now reacting to the very high inflation by aggressively raising interest rates. The tightening in policy settings is designed to slow down growth, rebalance demand and supply, and get inflation back down to target.

Over the past few months this abrupt shift in interest rate expectations has generated increased market volatility. The policy normalisation process is only part way done, and the economic impacts are yet to materialise. As such, volatility can continue for a while. The path forward for inflation will be critical for markets.

This is a developing environment, so as always, stay close to your adviser.

Tags

Disclaimer

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiaries of E&P Financial Group Limited (ABN 54 60 9913 457) (E&P Financial Group) and related bodies corporate.

This communication is not intended to be a research report (as defined in ASIC Regulatory Guides 79 and 264). Any express or implicit opinion or recommendation about a named or readily identifiable investment product is merely a restatement, summary or extract of another research report that has already been broadly distributed. You may obtain a copy of the original research report from your adviser.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. E&P Financial Group, its related entities, officers, employees, agents, advisors nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.evansandpartners.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.