Federal Budget 2024 – Implications For Markets

Looking at the 2024-25 Federal Budget, the key issues for markets and the economy are the impact on Australian consumption and interest rates.

There was significant stimulus to the consumer in the budget from the Stage 3 tax cuts, and the subsidies on electricity and rents. These point to an increase in disposable income of $30 billion over the next year. If this money is spent, then discretionary spending could rise materially. There were already good reasons to expect a bounce in consumption given the peak in interest rates and strong gains in household net worth in recent years.

Macro implications: consumer and interest rates

Looking at the 2024/25 Federal Budget, the key issues for markets and the economy are the impact on Australian consumption and interest rates. Could this cause a consumption boom?

There was significant stimulus to the consumer in the budget using the cover of the cost-of-living crisis. Some of the measures were:

- Tax cuts of $1000-4000 per person. The total effect is $25 billion per year. These were preannounced but are the largest single change for the next year.

- Electricity subsidies of $300 for every household ($3.5 billion/yr) and rent relief ($2 bill)

Adding these together, the net result is the potential for an increase in disposable income of $30 billion over the next year. There were already good reasons to expect a bounce in consumption at some point this year:

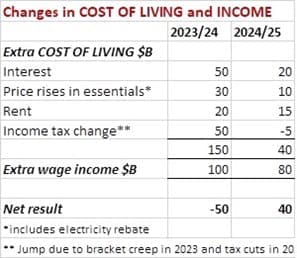

- Cost of living pressures were easing anyway as inflation and interest rates were peaking. The hit in 2023/24 was $150 billion as detailed below while the additional hit in 2024/25 is likely to be a much smaller $40 billion after incorporating these budget measures. That is a $110 billion turnaround in spending power.

- We estimate that there are still $200 billion in accumulated excess savings from the COVID years sitting in bank accounts. Households had to dip into those savings for $50 billion last year but they could generate a $40 billion surplus over the next year.

- Household net worth has risen by $1 trillion over the past year due to price rises in housing and stocks – wealth effects are strong.

When we think about what this might mean for discretionary consumption. The ABS estimates that total discretionary consumption is around $530 billion. If the $40 billion surplus is spent then discretionary spending could rise by 7.5% but there is a compelling argument for a rise of more than this given wealth effects and the potential for a turn in consumer confidence which is particularly low at present.

Source: ABS, E&P calculations

Market and asset allocation implications

While unlikely to materially influence markets in the short-term, some of the potential implications of the budget on returns are:

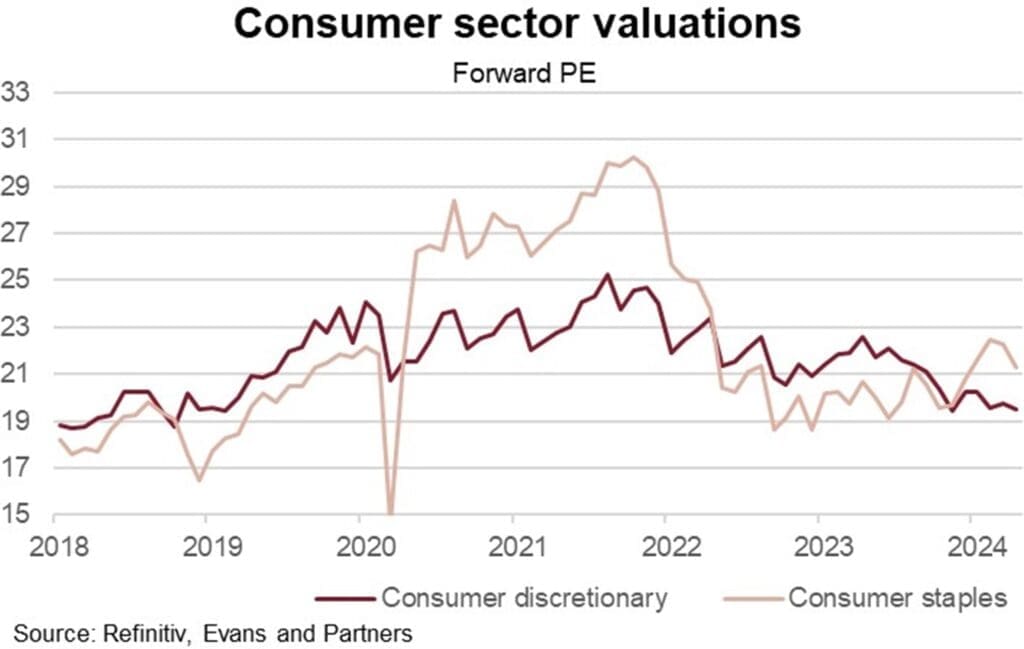

- Strong consumption can support the overall economy and may present an opportunity to accumulate consumer stocks that are trading at reasonable valuations. There is, however, no change to our investment view on the larger discretionary consumer stocks.

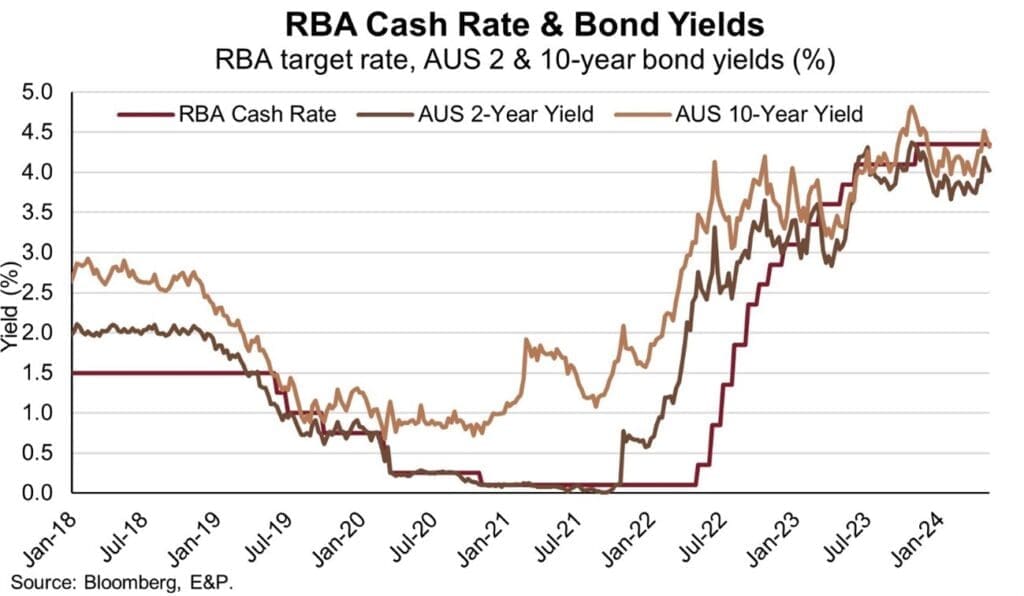

- A stronger economy could push out the timing of rate cuts by the RBA – potentially until the end of 2025. This could put upward pressure on yields as bond markets re-price interest rate expectations. With this in mind, we still think a rate hike is unlikely as this would require a material change in the outlook for the labour market and wages. The RBA will not be swayed by the reduction in inflation from government subsidies since their preferred measure of core inflation (the trimmed mean) will ignore this effect.

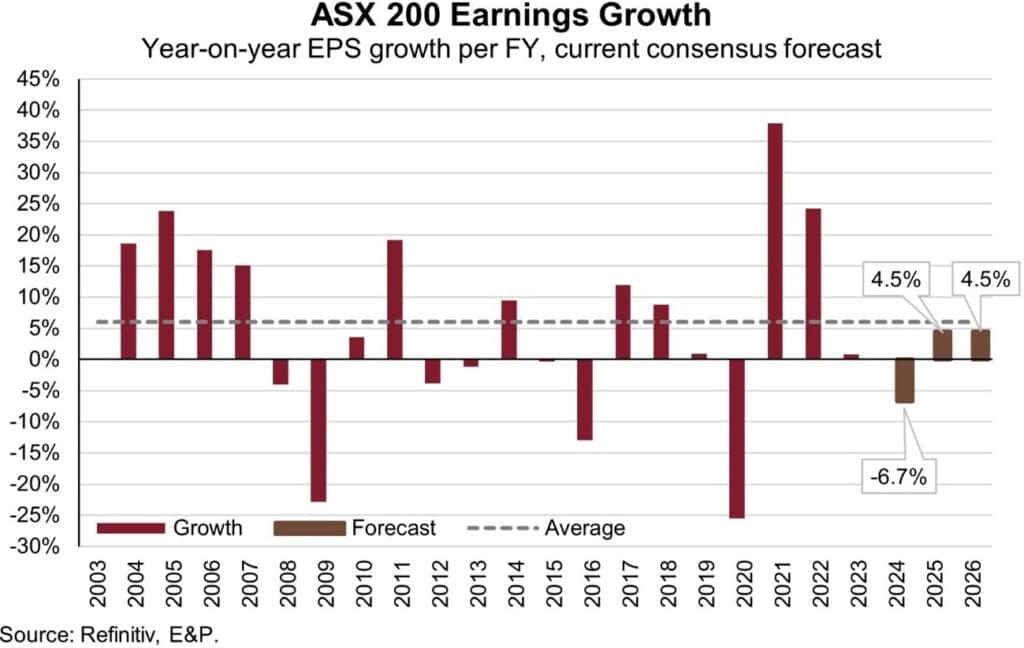

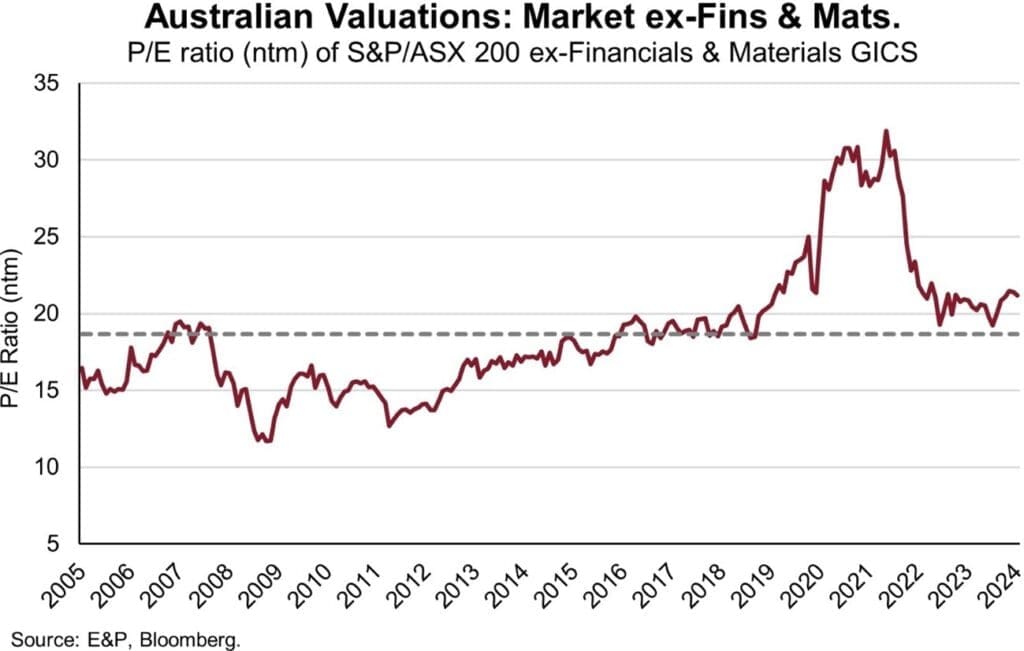

Government stimulus may provide some support for corporate earnings however we believe this is at the margin. The earnings outlook for the Australian equity market remains relatively benign (~1% compound annual growth rate (over the next 3 years) thanks to the index heavyweights (financials & materials). The outlook is better when stripping these out of the equation, however this leaves investors with a market multiple of 22x (vs. S&P 500 @ 19x) and is encouraging us to preference global equity markets over domestic.

The potential spillover effects into bond markets reiterates our preference for floating rate credit investments. Government bond markets continue to prove incredibly volatile, and are relatively unattractive while yields remain under 5%. In contrast, domestic listed credit markets continue to perform incredibly well with spreads narrowing against a backdrop of positive economic growth and sound credit quality. Likewise, selective private credit exposures should continue to perform in this environment with elevated base rates driving enticing all-in yields (~10%). This broad opportunity set – across both listed and private credit – is a driving factor behind our ‘overweight’ interest rate securities call.

Tags

Disclaimer

This communication was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate.

This communication is not intended to be a research report (as defined in ASIC Regulatory Guides 79 and 264). Any express or implicit opinion or recommendation about a named or readily identifiable investment product is merely a restatement, summary or extract of another research report that has already been broadly distributed. You may obtain a copy of the original research report from your adviser.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. Neither E&P Financial Group, its related entities, officers, employees, agents, advisers nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.