Is the Investment Outlook for Commercial Property Improving?

Commercial property, once challenged by rising interest rates and structural shifts like remote work, is showing early signs of recovery. Improving demand, constrained supply, and stabilising valuations are driving renewed investor interest.

A Turning Point for Commercial Property Investors

With many traditional asset classes being challenged by stretched valuations and lower income generation, investors have increasingly turned towards the Alternatives asset class. Within the Alternatives universe, investors have been drawn towards private equity and private credit over commercial property. This is primarily due to commercial property facing a variety of pressures in recent years, both cyclical (notably higher interest rates) and structural (e.g. the impact of higher working from home on the office sector).

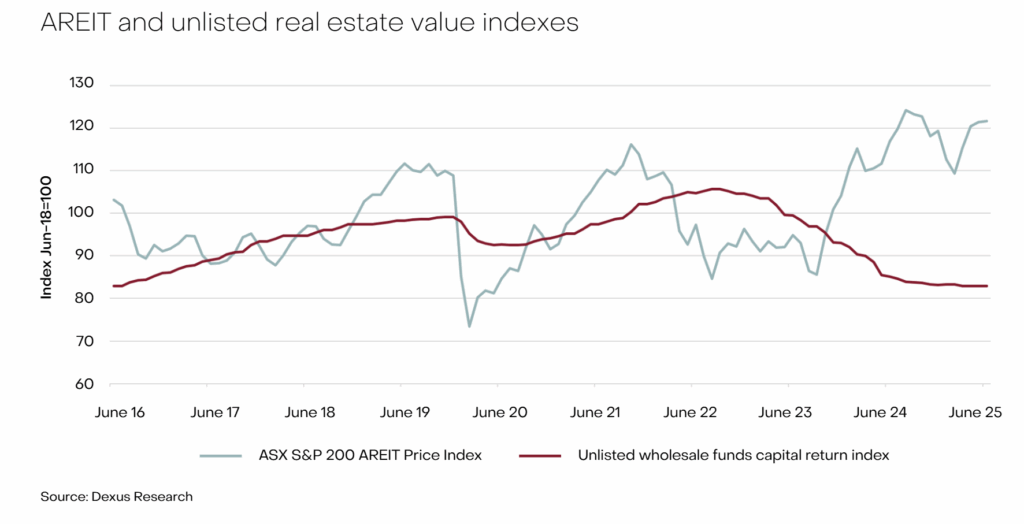

Returns have started to recover in the listed Real Estate Investment Trust (REIT) sector, as lower interest rates have driven a stabilisation in asset valuations and the cost of capital. Corporate activity has also returned to the sector, which should provide a floor for equity valuations. Income seeking investors have perhaps benefited less during this recovery though, given a large portion of the improvement of the listed REITs has been generated by the low yielding developer/fund managers Goodman Group and Charter Hall.

Beyond listed REITs, which can be subject to significant market volatility, income seeking investors can access commercial property through a wide variety of unlisted investment vehicles, ranging from diversified managed funds to single asset syndicates. Whilst typically less volatile, these vehicles can be highly illiquid, so investors need to exercise caution and be wary of disproportionate risk.

Improving Fundamentals Support Sector Recovery

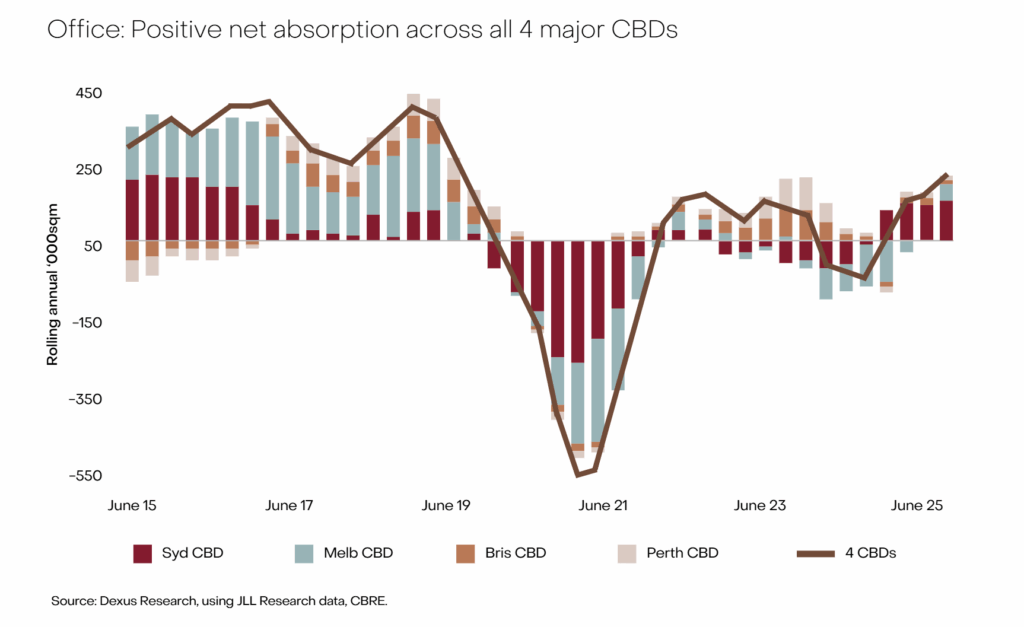

Signs of a recovery are now emerging for the commercial property sector. The sector will always be hostage to the macro outlook, and in particular market sentiment around interest rates, but improving demand and supply fundamentals is driving greater investor interest. In terms of demand, retail occupancy has recovered to pre-pandemic levels, while industrial vacancy remains low by historical standards, given positive structural drivers such as the growth of e-commerce. Rents have also started to improve in the office sector as the right-sizing of tenancies post COVID has eased. This has allowed ongoing population and employment growth to return as the pre-eminent drivers of demand for space.

Whilst demand indicators are improving, the strongest driver of an improving outlook for commercial property is the lack of growth in supply. Higher construction costs now mean that market rents are well below effective rents (i.e. the rent required to incentivise new developments). In the office sector, average per annum completions over the next three years in Sydney and Melbourne are expected to be 54% and 57% of the last ten-year averages respectively. Speculative supply growth in the industrial sector has shrunk, with the timing of many planned developments being pushed out as developers seek to de-risk higher costs through greater pre-leasing. Planning restrictions remain a key barrier to growing supply in both the industrial and retail sectors.

Disclaimer

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate. This communication is not intended to be a research report (as defined in ASIC Regulatory Guides 79 and 264). Any express or implicit opinion or recommendation about a named or readily identifiable investment product is merely a restatement, summary or extract of another research report that has already been broadly distributed. You may obtain a copy of the original research report from your adviser. The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance. The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. Neither E&P Financial Group, its related entities, officers, employees, agents, advisers nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information. The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge. The information provided is correct at the time of writing or recording and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained. Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

Tags

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.