Ongoing Pressures Within the US Office Sector

The combination of structural changes and cyclical pressures has proven to be a toxic mix for those who fund and invest in the US office sector.

While the growth in working from home stimulated by the pandemic is a well-worn theme at this point, it continues to have a significant impact on the US office market. Put simply, the decline in demand has been significant and shows little sign of returning to pre-pandemic levels. This structural change, combined with a cyclical increase in interest rates, is creating headaches for anyone exposed to commercial real estate.

The impact of interest rates

Higher interest rates impact commercial property in two ways. Firstly, they increase the discount rate used in asset valuations, which reduces those values. Secondly, they increase the cost of debt, which reduces the cash flow available to service debt and equity. This latter factor can cause pain if the landlord has high gearing and long leases without inflation protection.

Flow-on effects on markets

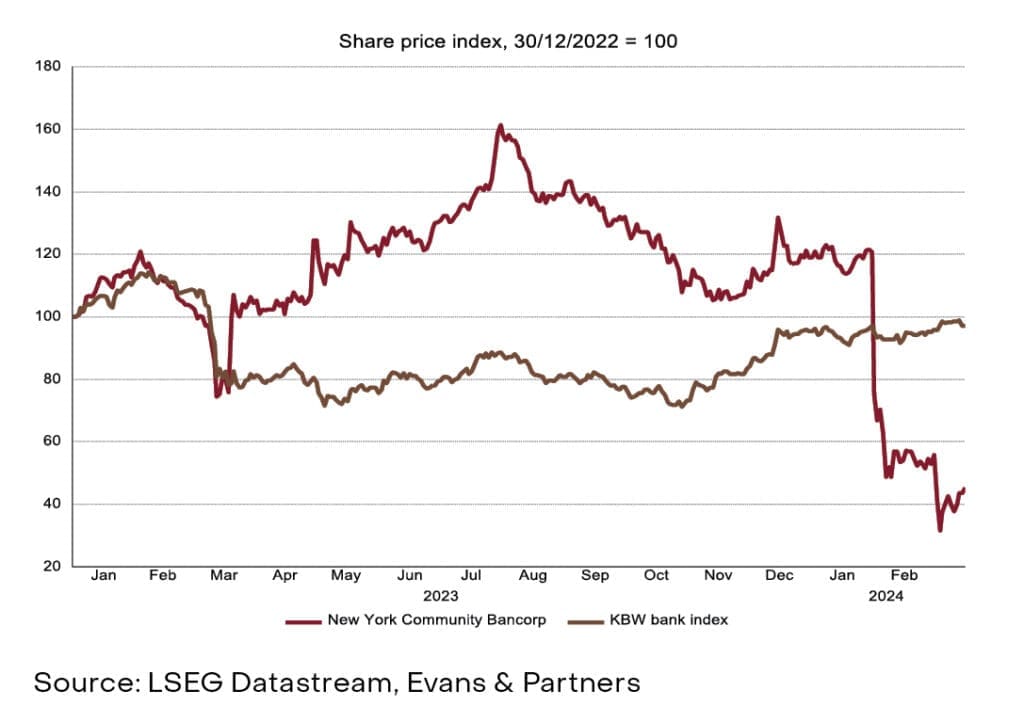

Pressures in the US office sector first caused noticeable impacts in global bond and equity markets in early 2023. The failure of banks exposed to technology risks such as Silicon Valley Bank led to greater focus on the material increase in commercial real estate financing taken on by US regional banks in recent years. These risks resurfaced in February this year when New York Community Bancorp surprised investors by cutting its dividend and flagging a US$522 million increase in credit loss provisions related to property. According to Trepp research, ~US$300 billion of loans in US commercial real estate will mature in the next 24 months. Markets are concerned about many borrowers’ ability to refinance these loans given the higher cost of capital, stricter underwriting terms and falling values pressuring loan-to-value ratios.

Challenged fundamentals

Operating trends in the US office sector remain challenged. According to Cushman & Wakefield, the US national office vacancy rate increased last year by 200 basis points to an all-time high of 19.7%. Vacancy in the largest market, midtown Manhattan, is 22.3% whilst other key markets such as Los Angeles (26.2%) and San Francisco (32.5%) are also underperforming. Vacancy remains elevated in the US given a weaker return-to-office rate. JLL Research data at end 2023 indicates that weekday office entries in the US were at 55% of 2019 levels compared to 75% in Europe and 85% in Asia Pacific. Whilst there are signs that US leasing demand is starting to recover, it is improving off a very low base, with current demand estimated to be about 30% below pre-pandemic levels.

Monitoring domestic trends

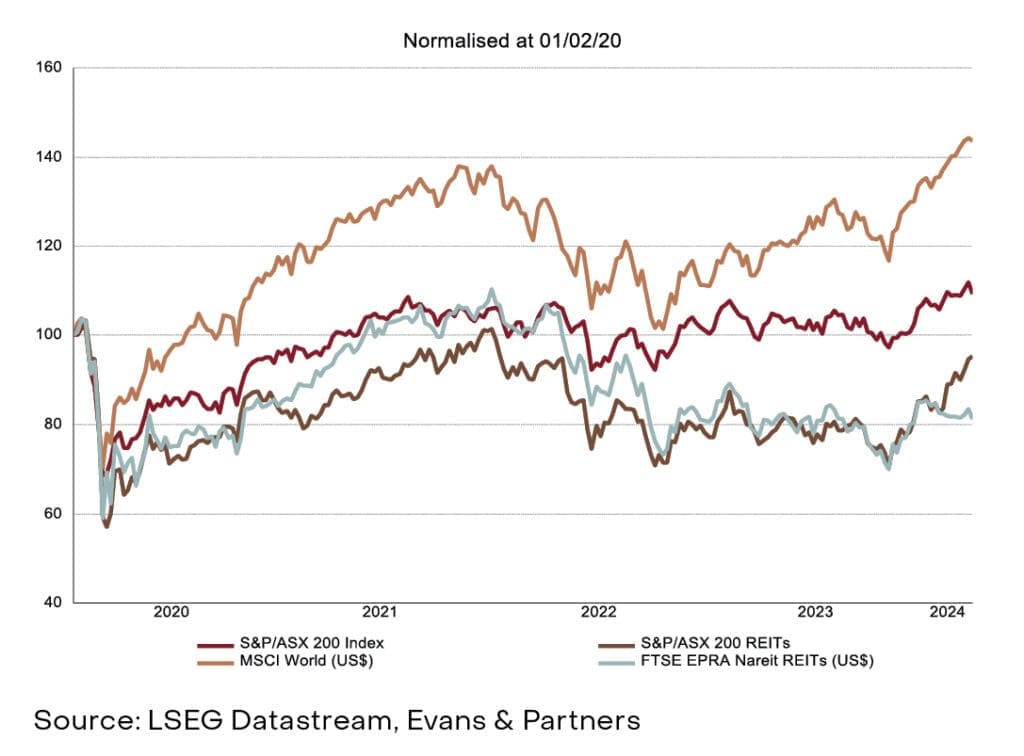

Global investors will continue to monitor the health of the US office sector closely, given the potential risks to the financial strength of the US regional banks. Locally, there are several impacts we must pay close attention to. Despite much stronger fundamentals in Australian commercial property, local real estate investment trust (REIT) share price performance in CY23 appeared to be closely aligned to US peers. Whilst we remain cautious on local office exposure, there are some signs that investors are beginning to recognise that non-office exposure shouldn’t be trading at similar valuation levels to those REITs with office risk.

Separately, we note that trends in the US involving a preference for premium, modern offices which enable tenants to meet climate goals are also playing out here. This has the potential to create stranded assets out of older, lower-grade buildings that don’t meet these higher standards.

New York Community Bancorp Struggles

US & Australian REIT Underperformance

Tags

Important Disclosures

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information provided is correct at the time of writing or recording and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained.

Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.