Operation Rotation: Macro Overview

The current challenge for investors is how to trade off short-term uncertainty with their long-term investment goals.

Walking the Tightrope

The short term remains uncertain. A US recession appears less likely now but a material slowdown should still be expected and this has the potential to cause more market volatility, particularly given the sharp bounce back and elevated valuations in markets. But this needs to be balanced against the opportunities created by a range of compelling, enduring structural changes that will continue to create opportunities for investors, most notably developments in Artificial Intelligence (AI) and the Clean Energy Transition.

Storms Clearing… For Now

Markets have responded positively as the risks from the trade war and US Government austerity have faded. This has reduced the risk of a US recession. The economy has also proved to be relatively resilient so far with no major deterioration in key parts of the economy.

Nevertheless there are lingering risks, mostly to consumer spending and corporate earnings, which still have the potential to derail investor sentiment. Consumers will suffer the biggest hit from tariffs. Company earnings are also under threat, particularly in consumer-facing industries that may not be able to fully pass on tariff increases.

Big Themes, Bigger Opportunities

This macro uncertainty has the potential to affect equity markets but investors must balance this risk against their long-term investment goals and a number of significant secular economic changes that are underway and that will create a range of opportunities. The most prominent of these is Digital Disruption, as artificial intelligence technologies drive innovation and transform industries, creating significant opportunities for growth. The second major trend is investment to support the Clean Energy Transition, as governments and companies shift towards low-emissions technologies and infrastructure in response to climate commitments and changing energy demands. The third major trend is Health Innovation, driven by ageing populations and advances in biotechnology. We anticipate these long-term themes will support growth and provide opportunities, even amid current uncertainties.

Power Surge

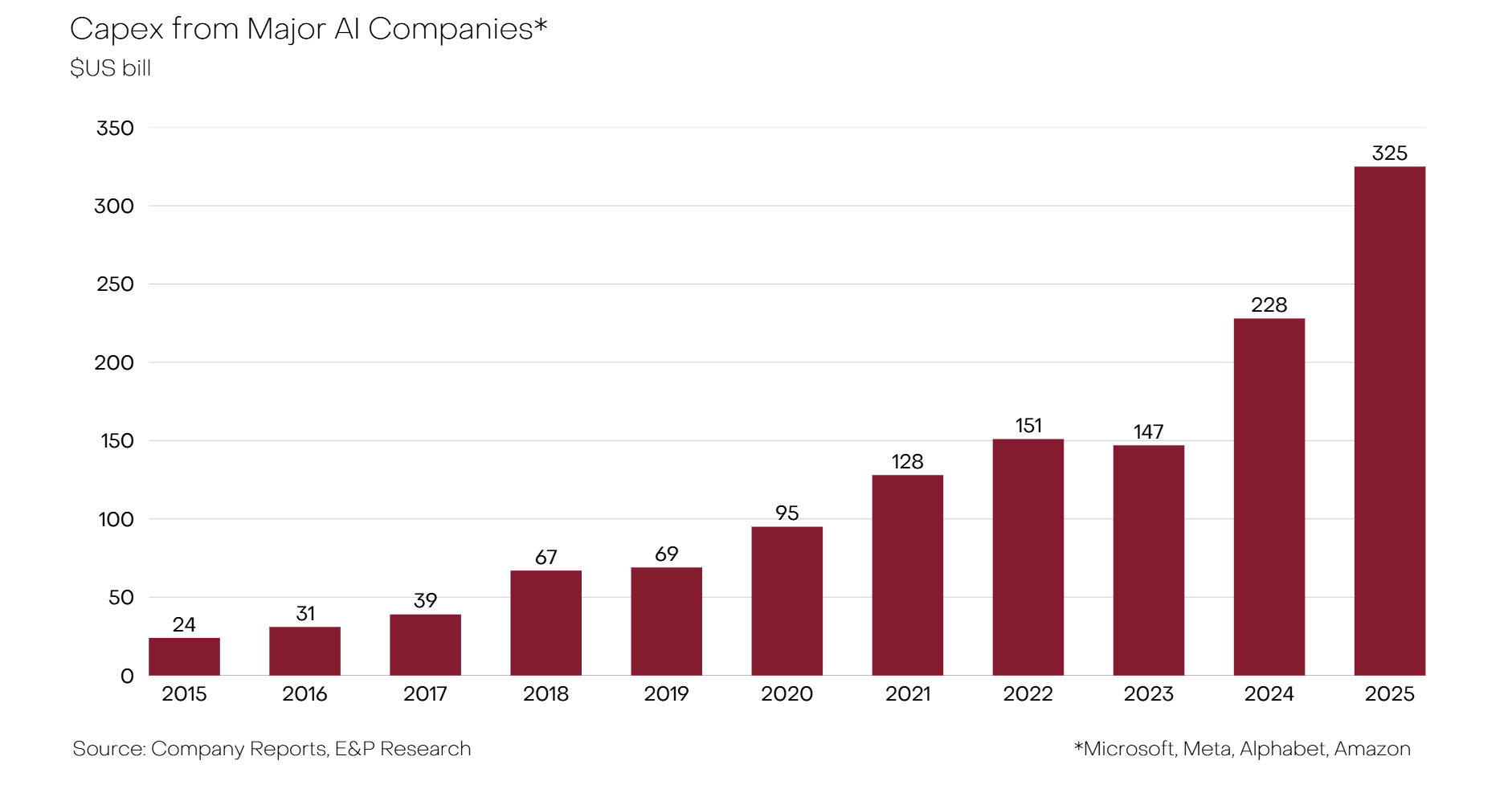

AI-related capex is now so large it will be an offset to weakness in other parts of the economy. Investment by the four major companies (Microsoft, Google, Meta and Amazon) has escalated rapidly and is forecast to be $325 billion in 2025 which is more than 1% of overall annual US GDP. This reflects accelerating adoption of AI across a broad range of industries, particularly finance, education, retail and health care.

As AI technology continues to evolve, its impact on various sectors will only grow, driving further advancements and adoption. There is a further impact on the economy through the electricity sector. Data centres, machine learning algorithms and autonomous systems require substantial computational power, leading to increased electricity consumption.

The boost to electricity demand for AI is occurring at the same time as a major investment wave in renewable energy gets underway. The clean energy transition and drive towards net zero emissions is poised to have a profound impact on the global economy and create new opportunities.

Final Thoughts

The best way to navigate this environment is to have some extra cash to take advantage of any opportunities, diversify to reduce the impact of volatility and look for beneficiaries from developments in Digital Disruption, Clean Energy Transition and Health Innovation. These may not be in listed markets and will be spread across geographies.

Disclaimer

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate. This communication is not intended to be a research report (as defined in ASIC Regulatory Guides 79 and 264). Any express or implicit opinion or recommendation about a named or readily identifiable investment product is merely a restatement, summary or extract of another research report that has already been broadly distributed. You may obtain a copy of the original research report from your adviser. The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance. The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. Neither E&P Financial Group, its related entities, officers, employees, agents, advisers nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information. The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Tags

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.