Global Assets Vs Australian Assets.

Most Australian investors still have too much exposure to Australian assets. This article looks at some of the reasons why and the role global assets can play in diversifying portfolios.

Dividends and income

Part of the mentality for Australian investors with Australian assets is traditional “home country” bias, but it also represents too great a focus on dividends and income at the expense of maximising total portfolio returns.

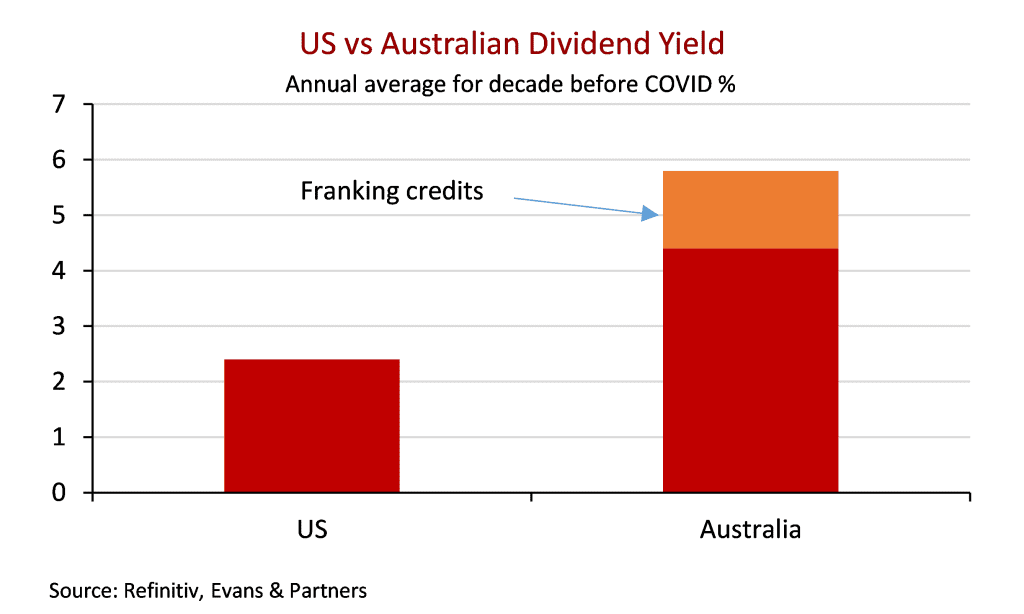

There is no doubt dividends levels are high in Australia. They are much higher than the rest of the world and there is the additional boost from franking credits for most investors. This tax advantage to dividends is unique to Australia and is the overwhelming reason why payout ratios are so high.

Figures in Chart 1 show from the 10-year period before COVID-19 there was an average dividend yield of almost 6 per cent after franking in Australia compared with 2.5 per cent for the US.

Chart 1

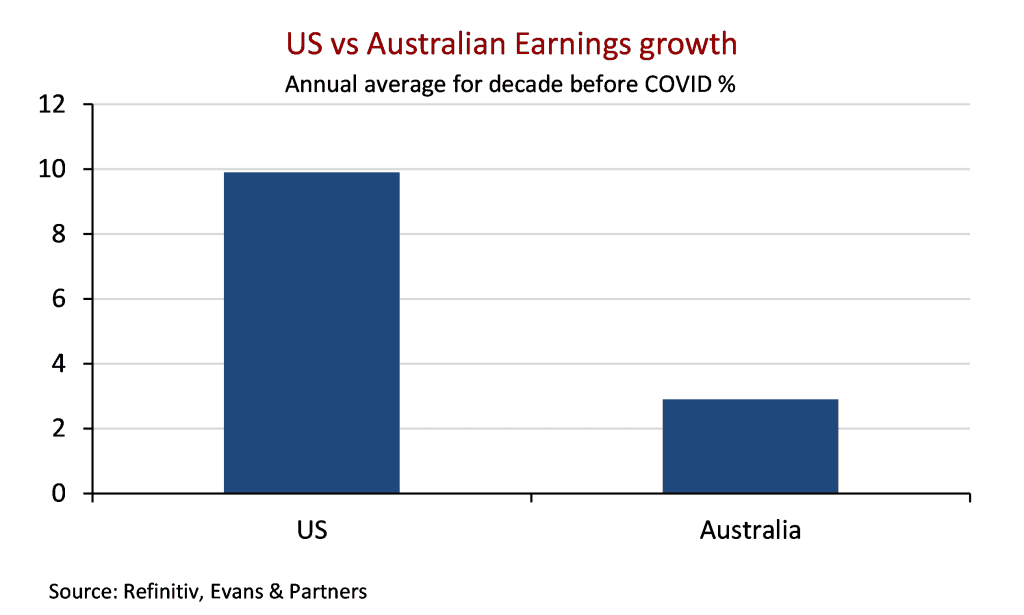

However, the pursuit of dividends does also come at a cost. Australian companies are mature and grow earnings per share (EPS) at a much lower rate than the rest of the world, so investors with portfolios with heavy biases to Australia miss out on that potential growth over time.

Chart 2 then shows that in the decade preceding COVID-19, US companies grew EPS at 10 per cent versus Australian companies that only grew by 2.5 per cent.

Chart 2

What are the considerations for investors?

If an investor has a long-term horizon, a balanced approach is to focus on total return and not just income, and there is good reason for this. If we look at the figures in Chart 1 and Chart 2 where yield and growth are added together as a rough estimate of total return, the US has a figure of 12.5 per cent and Australia at 9 per cent.

That difference is significant over time and would seem a high price to pay for a sole focus on dividends.

It should also be noted that a large part of this EPS growth in the US is due to buybacks, because companies in the US generally buyback shares ― rather than pay dividends ― so the steady reduction in the number of shares pushes up EPS.

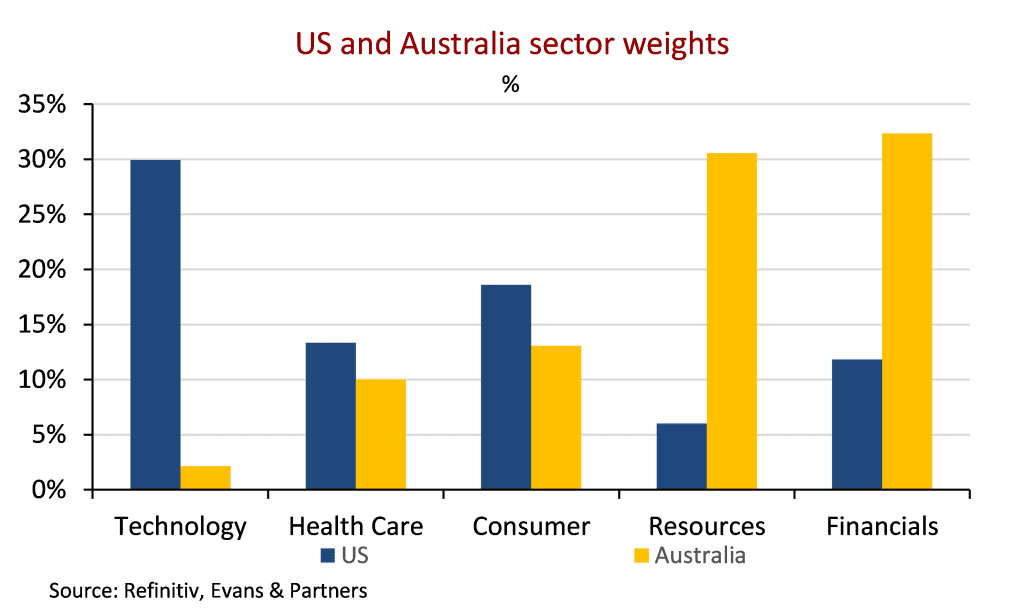

The second reason for higher earnings growth in the US is that their market has larger exposure to higher growth companies ― particularly in the technology sector where technology represents 30 per cent of the market ― compared to about 2 per cent of the Australian market.

In comparison, the biggest sectors in the Australian market – banks and resources – are very mature industries. And apart from some pockets of resources, it is hard to see substantial growth in these sectors, particularly when we consider that lending growth has stalled somewhat for the banks, and the iron ore boom is now well advanced.

These factors are important for investors with long horizons to consider – remembering that the duration of a portfolio should match the duration of the investor. So, investors looking to invest for the long term should invest in companies that are likely to experience the highest growth and total return in the long term. This should be a key element of discussions and planning with your adviser.

Tags

Disclaimer

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiaries of E&P Financial Group Limited (ABN 54 60 9913 457) (E&P Financial Group) and related bodies corporate.

This communication is not intended to be a research report (as defined in ASIC Regulatory Guides 79 and 264). Any express or implicit opinion or recommendation about a named or readily identifiable investment product is merely a restatement, summary or extract of another research report that has already been broadly distributed. You may obtain a copy of the original research report from your adviser.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. E&P Financial Group, its related entities, officers, employees, agents, advisors nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.