Opportunities in Global Private Credit

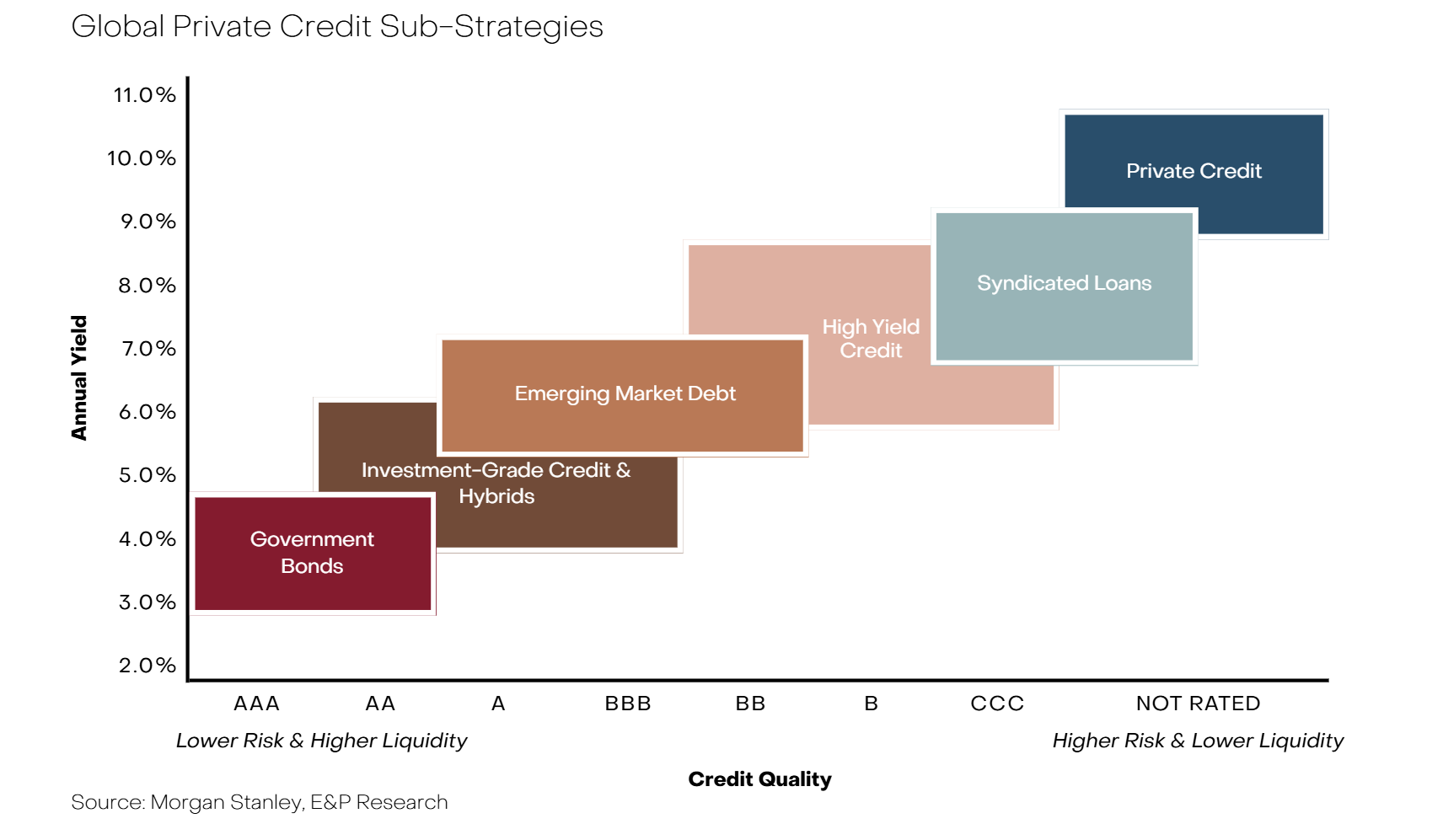

As bond markets adjust to a world of moderating inflation and falling policy rates, yields on traditional fixed income and cash holdings are beginning to decline. For investors seeking more resilient sources of income, global private credit has become an increasingly attractive alternative.

Private credit rose to prominence after the Global Financial Crisis, when regulatory reforms made it more difficult for banks to lend to small- and medium-sized enterprises. In response, private lenders began filling this gap, offering tailored financing solutions to businesses in exchange for higher interest rates and stronger covenants. Investors in private credit benefit not only from this yield premium but also from the ability to access bespoke lending markets that remain largely unavailable through public channels.

Today, as listed credit spreads remain tight and bond duration risk rises, the illiquidity premium offered by private credit, often several percentage points above public high-yield markets, can meaningfully enhance portfolio income. At the same time, falling interest rates on cash and term deposits are beginning to erode the appeal of sitting in short-duration assets, especially for investors with medium- to long-term income needs.

While domestic private credit options have expanded in recent years, much of the Australian market remains tied to property lending—particularly residential and development finance. Given the high concentration of household wealth already in real estate, further exposure to this segment may compound sector-specific risks. By contrast, the global private credit market offers far greater sectoral and geographic diversification, along with access to higher-quality borrowers and more robust underwriting standards.

Importantly, many global managers operate at a significantly larger scale than their domestic counterparts. They benefit from deeper origination networks, broader deal flow, and more extensive resources to conduct due diligence and manage risk. These attributes help drive better risk-adjusted returns and stronger capital preservation through credit cycles.

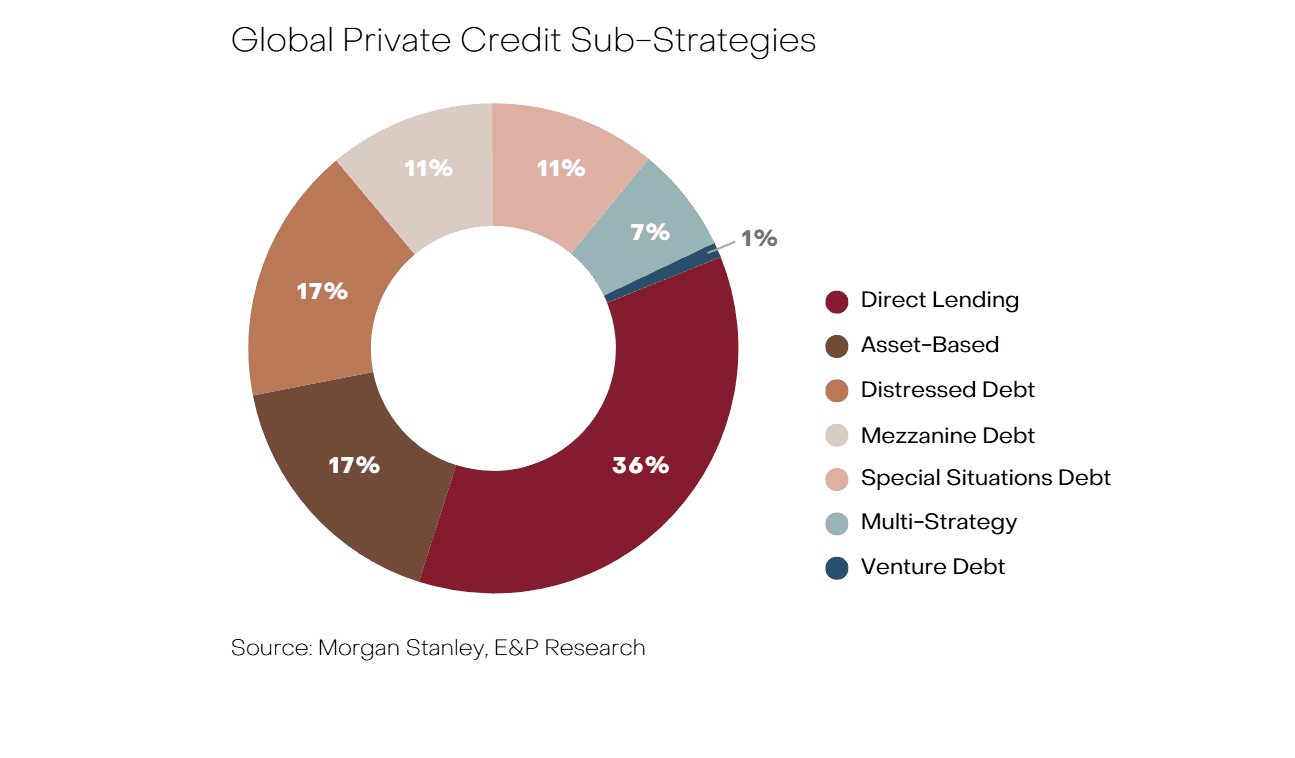

Within private credit, we see two core strategies as particularly compelling:

- Direct Lending, which involves providing senior secured loans to mid-sized businesses that fall below investment grade. These loans often feature strong structural protections, regular income payments, and bullet repayments of principal at maturity—making them a natural fit for income-seeking investors.

- Asset-Based Finance (ABF), which involves lending secured against tangible or contractual assets such as receivables, inventory, or property. These loans typically amortise over time, reducing credit risk and offering a smoother, more predictable income stream with solid collateral backing.

Why Manager Selection Matters

While the potential benefits of private credit are substantial, investors must remain mindful of the risks. These include lower liquidity, limited transparency, and the need for specialised credit expertise. For this reason, manager selection is paramount. We prioritise those with scale, deep underwriting discipline, and strong experience in managing borrower stress and recovering capital where needed.

In the context of declining returns on cash and increased volatility in listed markets, global private credit may provide an opportunity to secure higher, more stable income while enhancing portfolio diversification. We continue to identify opportunities across Direct Lending and Asset-Based Finance strategies that can help investors meet their income and capital stability objectives in the years ahead.

Disclaimer

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate. This communication is not intended to be a research report (as defined in ASIC Regulatory Guides 79 and 264). Any express or implicit opinion or recommendation about a named or readily identifiable investment product is merely a restatement, summary or extract of another research report that has already been broadly distributed. You may obtain a copy of the original research report from your adviser. The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance. The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. Neither E&P Financial Group, its related entities, officers, employees, agents, advisers nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information. The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Tags

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.