Opportunities in the ASX Health Care Sector

Despite sharp underperformance, health care remains a sector with compelling long-term potential and shouldn’t be written off. FY25 brought significant challenges, but also revealed signs of resilience, reinvention, and opportunity across key names like CSL and Cochlear. Behind the near-term pressures are strategic shifts and innovations that could drive a stronger growth trajectory ahead.

FY25 was a challenging year for the health care sector, with the S&P/ASX 200 Health Care Index underperforming the S&P/ASX 200 benchmark index by -18.5%. Notable underperformers included Ramsay health care (-33.8% relative) and CSL (-30.8% relative), with Sigma (+126.5% relative after its merger with Chemist Warehouse) and Pro Medicus (+96.4% relative) the outperformers.

CSL: Global Biotechnology Company

CSL has faced several headwinds in recent years: margin pressure in its core plasma franchise (Behring) arising from Covid disruptions; the failure of the CSL112 phase 3 trial; and weaker than expected performance from its recent acquisition of Vifor. This year, further pressures have arisen from potential regulatory changes in the US surrounding tariffs, ‘most favoured nation’ pricing, and risks to volumes and pricing in their Seqirus vaccine franchise.

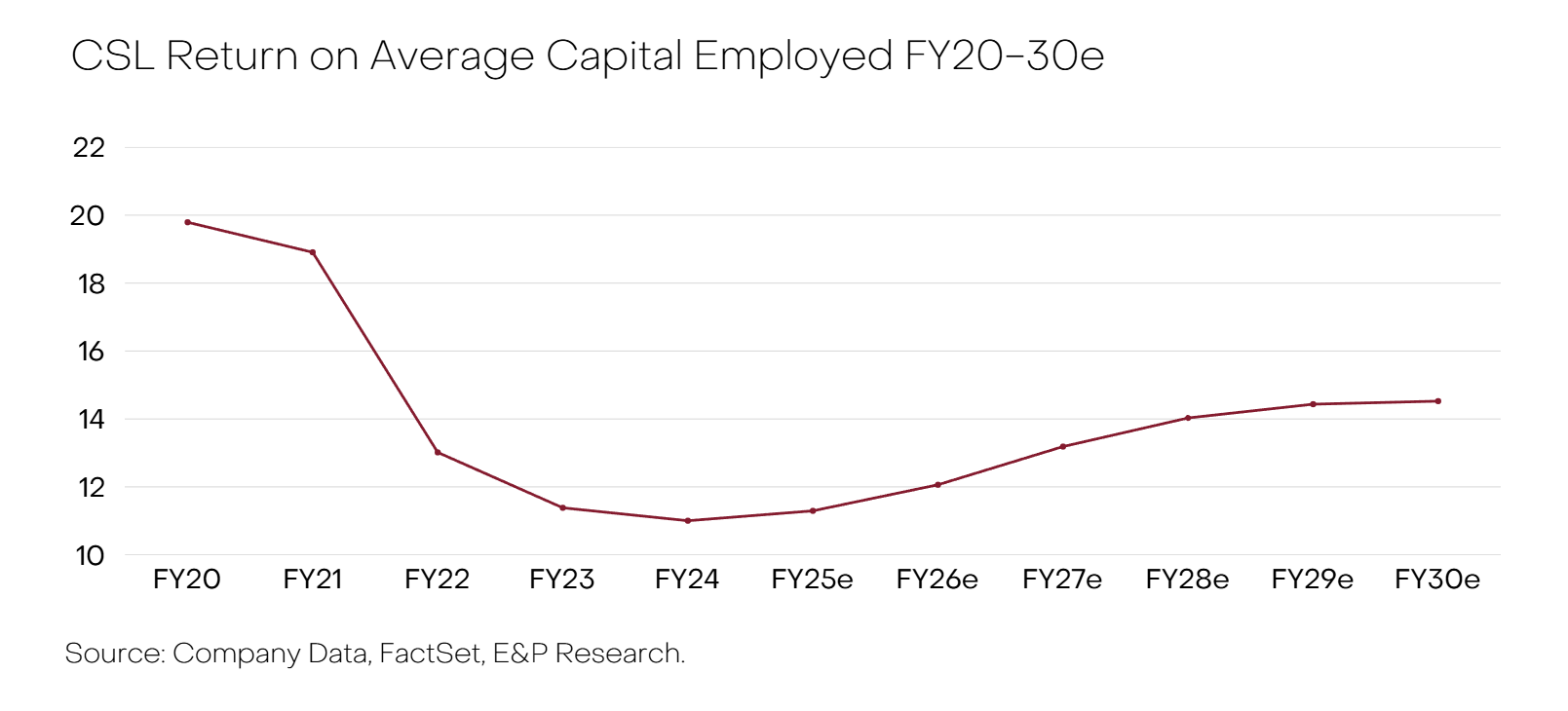

Whilst these near-term uncertainties have weighed on the stock, the medium-term outlook may be brighter. CSL is investing in a series of operational efficiencies in its core Behring franchise that should extend its structural margin advantage relative to peers. If successful, these initiatives should materially improve plasma economics and increase capacity at minimal incremental cost or capital. These initiatives, combined with the lagged impact of a recovery in volumes post COVID, are expected to deliver double-digit earnings growth and a material expansion in returns over the medium term.

Cochlear

Cochlear’s 1HFY25 result in February was marginally weaker than expected with Services sales (processor upgrades) below both the market’s and the company’s expectations, driven by cost-of-living pressures. FY25 guidance was then lowered in June, again driven by weaker Services performance, although this is expected to return to growth in FY26 with the launch of the Kanso 3 sound processor and improved candidate targeting.

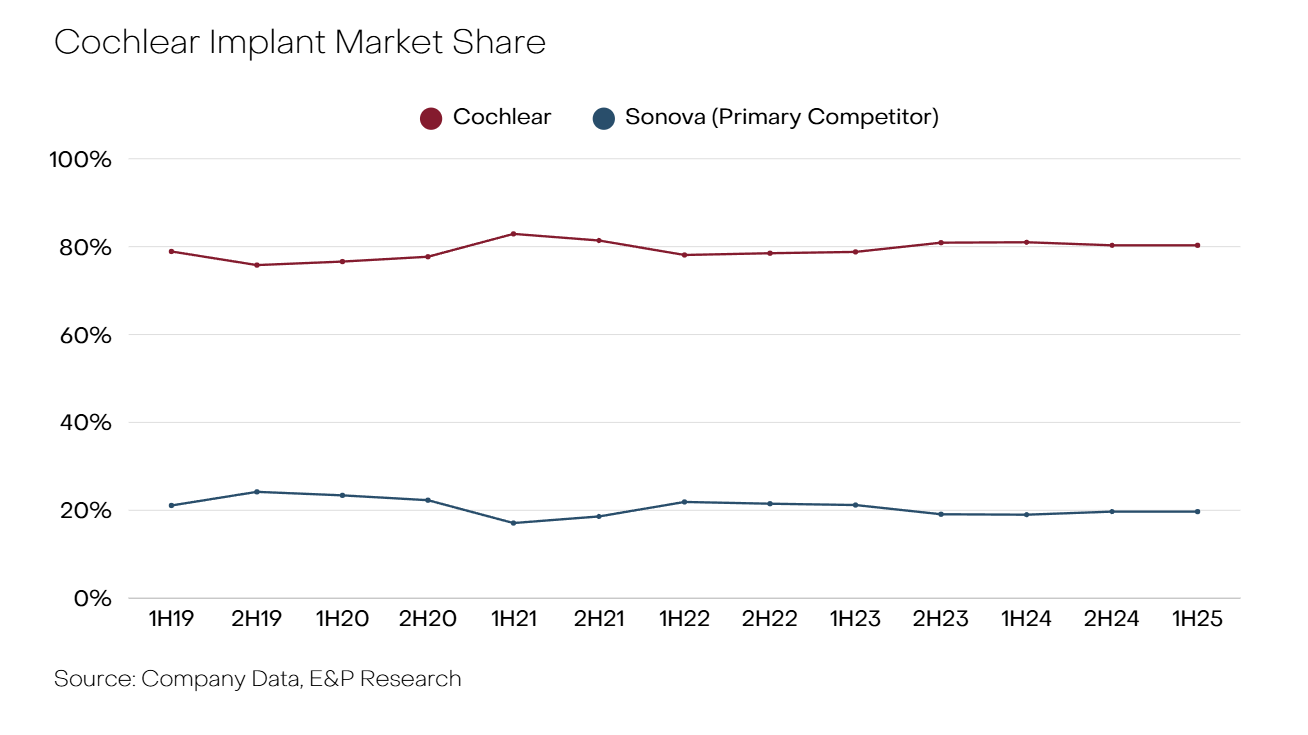

Whilst there has been short-term cyclical weakness, the longer-term story has arguably grown stronger with the launch of Cochlear’s next generation implant and processor, the Nucleus Nexa System. The new implant had been flagged, but the technology change is arguably greater than the market anticipated: it’s the first implant with an integrated sound processing module and memory which opens up a technology gap to peers that will be difficult to close. Some of the benefits of this new system will take time to manifest, but it should be a clear preference for patients given it future proofs a lifelong investment. It should underpin the opportunity for Cochlear to deliver double-digit sales growth into the long term given the size of their addressable markets, product innovation, and investment across the patient pathway.

Disclaimer

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate. This communication is not intended to be a research report (as defined in ASIC Regulatory Guides 79 and 264). Any express or implicit opinion or recommendation about a named or readily identifiable investment product is merely a restatement, summary or extract of another research report that has already been broadly distributed. You may obtain a copy of the original research report from your adviser. The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance. The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. Neither E&P Financial Group, its related entities, officers, employees, agents, advisers nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information. The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Tags

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.