Passing on Your Super: Estate Planning for Superannuation

For many Australians, superannuation is one of their largest assets. While most of us focus on how super will support our own retirement, it is just as important to plan for what happens to those funds when we pass away. Although a Will is commonplace, many Australians fail to address superannuation within their estate planning. Appropriate documentation and forward planning can help to reduce tax for your beneficiaries, provide certainty, and ensure your assets are passed to your loved ones smoothly.

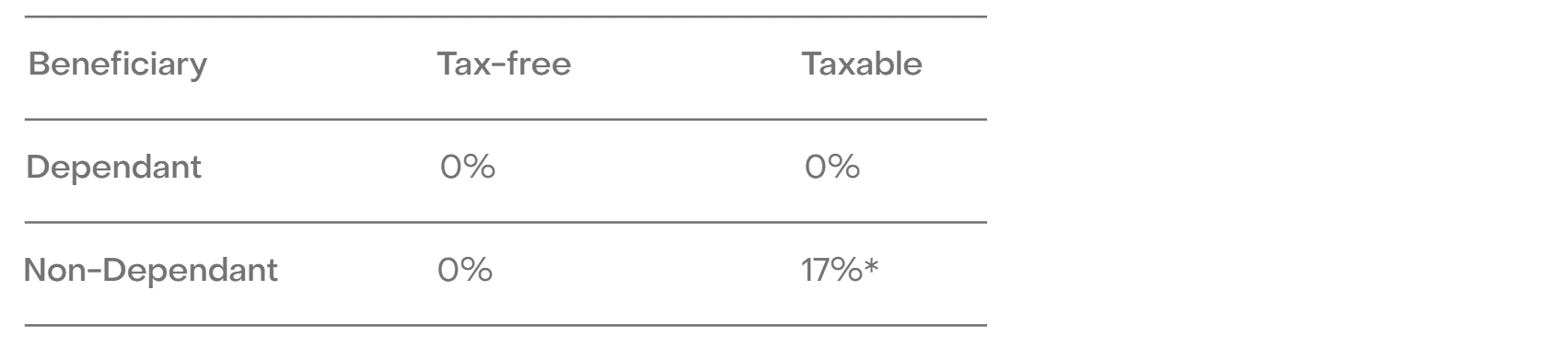

Understanding taxes for your beneficiaries

The starting point for passing on superannuation benefits is understanding the tax implications. When passing wealth to a dependant (generally a spouse or child under 18), no tax is payable by the recipient. In contrast, when wealth is passed to adult children, a tax of 17%* may be levied on the taxable component of your superannuation balance.

*Including the Medicare levy. The above table does not include the untaxed element, which is most commonly found in public sector funds. The untaxed element is generally taxed at 32% (including the Medicare levy) when paid to non-dependants.

The split between the tax-free and taxable components of your superannuation is unique to each individual and depends on how money was contributed to super. Contributions that provided a tax benefit, such as employer contributions, salary sacrifice arrangements, and personal contributions claimed as a tax deduction, add to your taxable balance. Your tax-free component consists of funds deposited without tax concessions such as non-concessional contributions.

Importantly, there are options available to manage this tax. This is known as a ‘withdrawal and re-contribution strategy’, which can increase the proportion of your balance considered tax-free and improve estate planning outcomes for certain beneficiaries. A complete analysis is available here.

The importance of the right paperwork

Unlike other assets, super does not automatically form part of your estate and requires documentation separate to your Will. It is the role of the superannuation trustee to determine who receives your death benefit. If you have not left clear directions, the trustee may exercise their own discretion.

The required paperwork is a death benefit nomination (or equivalent form) or a reversionary pension election. Recent data from the ABC and Super Consumers Australia shows that over a third of surveyed Australians aged 18 to 75 had not completed such paperwork. The absence of this can create uncertainty or disputes among potential beneficiaries and delay the distribution of funds.

For individuals who have previously completed the required paperwork, it is important to note that this may expire after a set period depending on the policies of your super fund. Reviewing your nominations regularly helps ensure they remain valid and aligned with your wishes.

Understanding your options for death benefit nominations

A death benefit nomination (or equivalent form) is a legal document that determines who will receive your superannuation when you pass away. Typically, there are three options to consider:

- Non-binding nominations: These record your preferences but leave the final decision to the trustee of your super fund. The trustee will consider your wishes alongside your broader circumstances, such as the needs of your dependants. This may result in less certainty about how your super is distributed.

- Binding nominations: This type of nomination directs the trustee to pay your super in line with your instructions. Provided your instructions are legally valid, the trustee is required to honour them.

- Reversionary pension nomination: Individuals with an account-based pension can elect a reversionary pension, which allows income payments to continue uninterrupted to a nominated beneficiary (usually a spouse, as children are not eligible to receive such income). It also provides 12 months for the surviving spouse to restructure their own super if it exceeds the Transfer Balance Cap due to inheriting the deceased’s super.

When completing a death benefit nomination, you can request that funds be transferred to your Legal Personal Representative to be distributed as per your Will or nominate individuals directly. Where an individual is named, they must meet the criteria of a dependant. Under Superannuation Law, a dependant is a spouse, child (of any age), or a person with an interdependency relationship. A complete list is available here.

Leaving a legacy

It is increasingly common for individuals to consider how their superannuation can create a lasting impact beyond supporting their immediate family. For those without beneficiaries, directing funds to philanthropic causes in a structured manner ensures that wealth is transitioned with purpose and continues to benefit the community. Even where beneficiaries are named, allocating a portion to philanthropy can provide a meaningful balance between supporting loved ones and contributing to causes that reflect your values. The Evans and Partners Foundation (discussed here) is one such avenue for clients looking to transform one-off donations into a deliberate, enduring impact that compounds over time.

Overview

Passing superannuation assets to beneficiaries can be complex, but appropriate paperwork and planning can greatly simplify the process. An Evans & Partners financial adviser can provide personalised guidance on preparing your superannuation to be inherited in a tax effective manner, while also liaising with your estate planning lawyer and accountant to ensure your documentation is reflected with your super fund. As individuals need to select the right nomination type and nominate valid beneficiaries, we strongly recommend seeking specialist advice to ensure your super transitions smoothly to your beneficiaries.

Disclaimer

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information provided is correct at the time of writing or recording and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained.

The information contains projections and forecasts (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. Neither E&P Financial Group and its related entities make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information. Results are only estimates, the actual amounts may be higher or lower. We cannot predict things that will affect your decision, such as changing interest rates. Seeking professional personal advice is highly recommended before acting on any such assumptions. Past performance is not a reliable indicator of future performance.

Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at https://www.eandp.com.au/disclosures/. Please let us know if you would like to receive a hard copy free of charge.

Tags

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.