Strategic Gifting: Empowering the Next Generation Without Compromising Your Own

For financially secure retirees, supporting adult children can be a meaningful way to pass on wealth early. Beyond the emotional rewards, strategic gifting offers financial advantages. With no gifting taxes or limits in Australia, there’s flexibility, but rising property prices, cost-of-living pressures, and complex tax rules make thoughtful planning essential.

Why Consider Strategic Gifting?

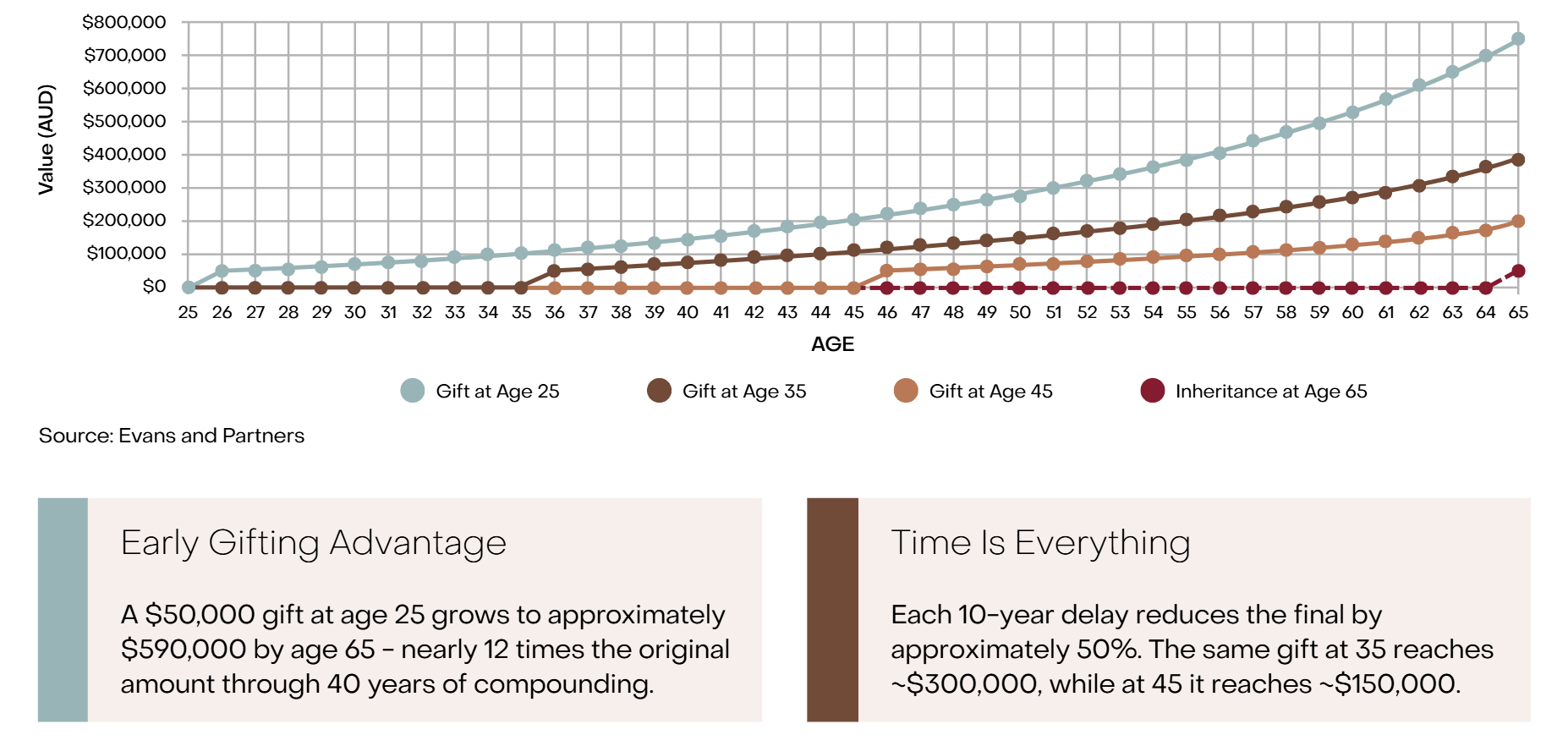

Compounding Benefits

Starting early provides significant advantages: even modest gifts can grow into substantial wealth over decades. Early support gives children the head start to invest, build assets, and form sound financial habits. This often results in achieving outcomes that would be unattainable if the same resources arrive later in life.

Chart Assumptions

- No additional contributions after initial gift

- Returns shown are pre-tax and do not account for inflation

- Actual returns will vary and past performance does not guarantee future results

Please note, the above table is for illustrative purposes only and does not constitute advice. The actual outcome will vary based on market movements, fees, insurance premiums, tax paid, and your relevant personal circumstances. The portfolio growth rate of 7% is based on the average 10-year return of a typical balanced portfolio as per Superratings. Individual performance may also differ due to timing of transactions or investment size of holdings.

Division 296 Benefits

Gifting can help reduce exposure to the proposed Division 296 tax that will apply to super balances over $3M. After exploring options like rebalancing with a spouse or investing outside super, gifting may be an effective way to redistribute wealth.

Managing Excess Income

Retirees drawing tax-free pensions from superannuation must meet minimum withdrawal rates. These start at 4% p.a. from age 60, rising to 11% past 90. As spending often declines with age, excess income may sit idle. Redirecting this surplus to children or grandchildren for investment ensures continued growth.

Why Consider Strategic Gifting?

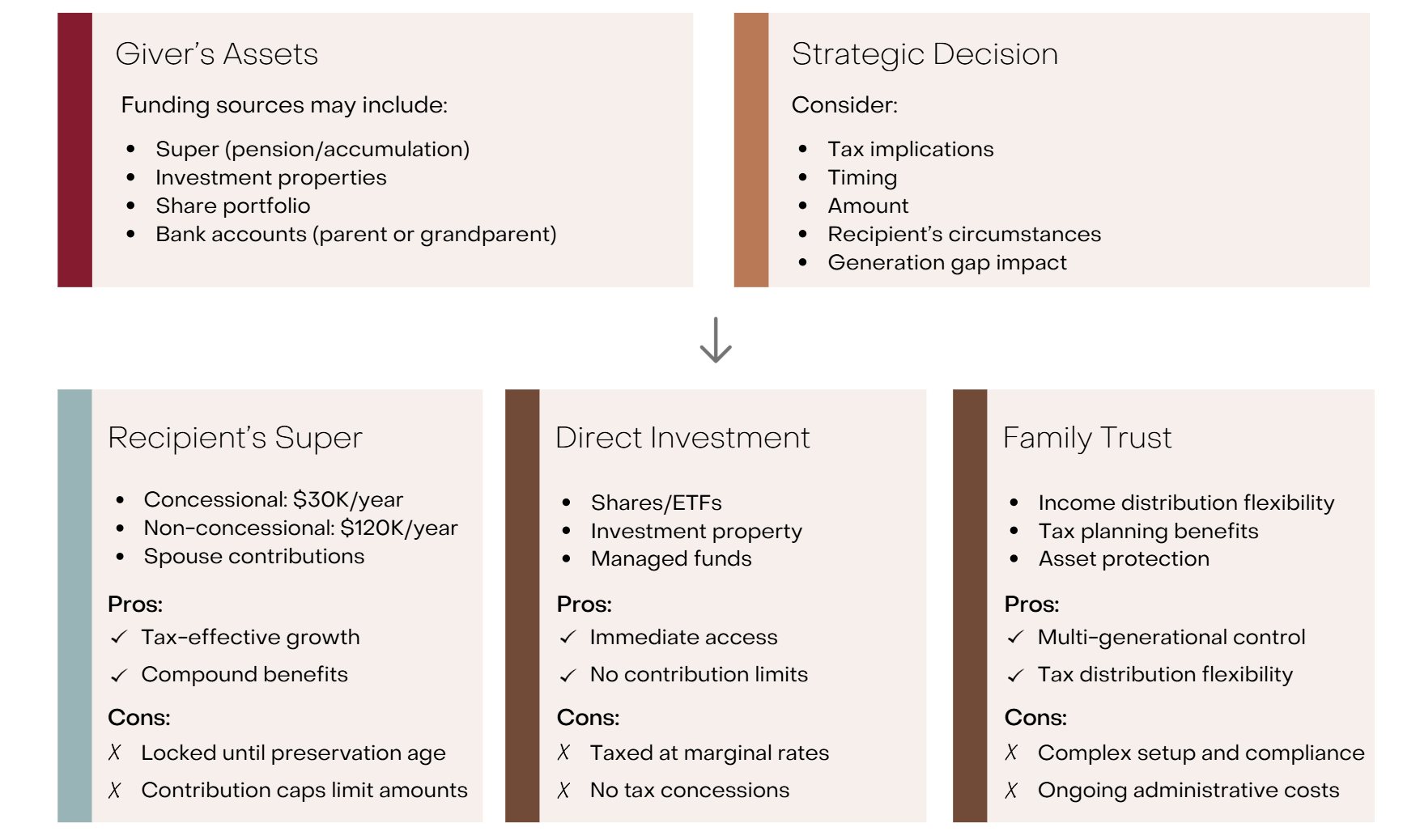

Rather than waiting until assets are distributed through your estate, carefully planned gifts now can be more effective, allowing your children to take advantage of opportunities , such as personal tax savings on super contributions or diversified investment opportunities.

How funds are passed on to the next generation will depend on a range of factors. For example, grandparents gifting to grandchildren should consider the child’s parents tax situation, potential impact on means testing and the longer investment timeframe available for compound growth.

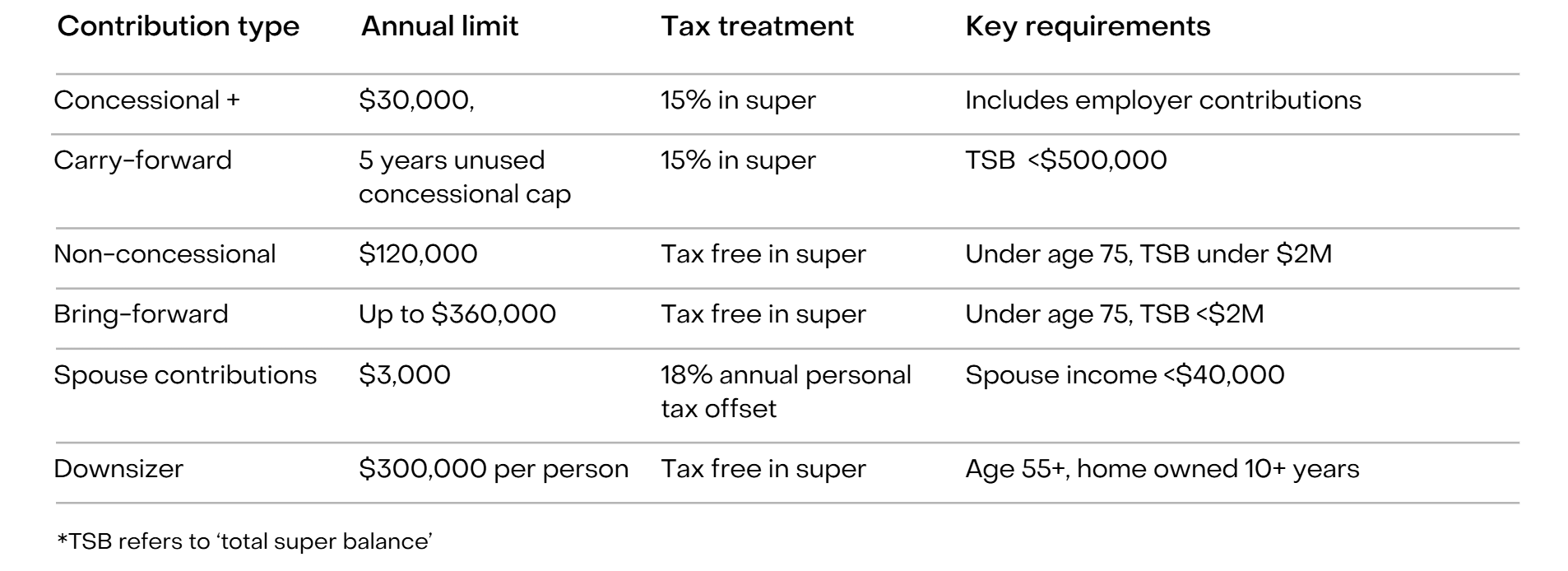

Maximise Super Contributions

Super remains one of the most tax-effective vehicles to build wealth long term. With a variety of contribution options available, it’s often worth exploring multiple types to find the combination that best suits the circumstances.

Explore Trusts and Companies

If super caps are reached, family trusts or investment companies may offer flexibility. Trusts allow income distribution to low-income family members or corporate beneficiaries, supporting long-term wealth building. These structures require professional advice but can be powerful tools for intergenerational planning.

Tax Considerations

If assets are sold to fund gifts, timing matters. Spreading sales across financial years or waiting until after age 60 may reduce capital gains tax. Recipients investing personally may face income tax and future capital gains tax . High-income children contributing to super could also be impacted by Division 293 tax. With planning, these impacts can be managed to avoid eroding the value of your gift.

Professional Collaboration

Bringing together financial advisers, legal experts, and tax specialists ensures your generosity is both impactful and sustainable. Professional guidance helps you understand structures such as trusts and companies, optimise tax outcomes and align gifting with your estate and retirement goals. Just as importantly, collaboration ensures flexibility, so your strategy can adapt if your children’s income changes, your own goals evolve, or legislation shifts, without compromising your financial security.

Disclaimer

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate. This communication is not intended to be a research report (as defined in ASIC Regulatory Guides 79 and 264). Any express or implicit opinion or recommendation about a named or readily identifiable investment product is merely a restatement, summary or extract of another research report that has already been broadly distributed. You may obtain a copy of the original research report from your adviser. The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance. The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. Neither E&P Financial Group, its related entities, officers, employees, agents, advisers nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information. The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge. The information provided is correct at the time of writing or recording and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained. Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

Tags

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.