Strategies for the new financial year

As we commence a new financial year it is important to revisit your finances, particularly in light of recent changes to the superannuation system. Central to these changes is the 0.5% increase in the Superannuation Guarantee (SG), bringing it to 12%. Understanding the potential long-term impact of this adjustment may also provide an incentive to implement a broader range of contribution strategies. The Government has also increased the amount able to be held in the retirement phase of super and has drafted legislation for the proposed Division 296 tax.

Understanding the Superannuation Guarantee

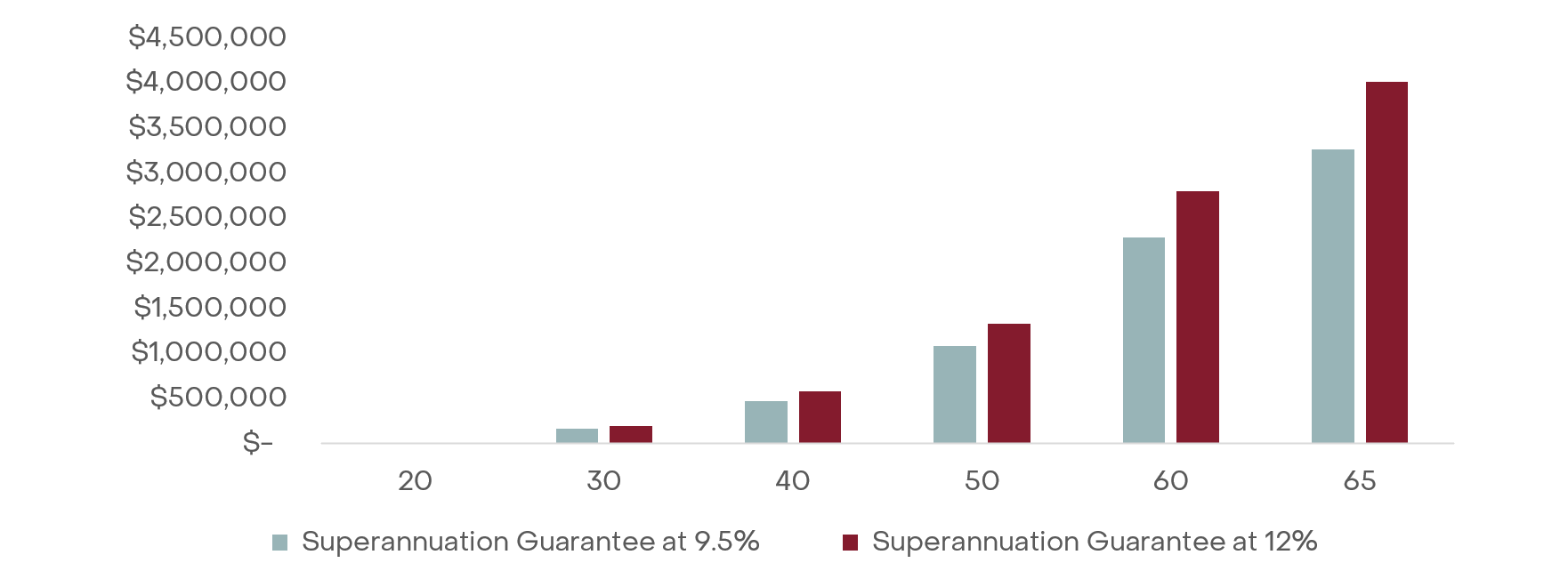

The Superannuation Guarantee (SG) is the minimum contribution made to an employee’s superannuation account. From 1 July 2025, the SG has increased to 12%, marking the final step in a gradual rise from 9.5% in 2020. Although the most recent increase is only 0.5%, the cumulative effect is likely to significantly influence the retirement outcomes of many Australians. For example, an individual earning $150,000 per year (inclusive of superannuation) throughout their career may benefit from an additional ~$742,000 in retirement savings, despite only contributing around $137,000 more through the higher SG rate (12% compared to 9.5%).

Consideration: Account for an increased SG payment as a proportion of your concessional contributions this financial year. Individuals contributing up to the $30,000 concessional limit may need to adjust their contribution strategies.

Source: E&P

Please note, the above graph is for illustrative purposes only and does not constitute advice. The actual outcome will vary based on market movements, fees, insurance premiums, tax paid, and your relevant personal circumstances. The starting balance is $5,000 at age 20. The portfolio growth rate of 7% is based on the average 10-year return of a typical balanced portfolio as per Superratings. Individual performance may also differ due to timing of transactions or investment size of holdings.

Maximise your super contributions

Employer contributions are not the only means of building your superannuation balance. Concessional contributions such as salary sacrifice arrangements or personal bank transfers into superannuation (where a tax deduction is claimed) can also help grow your retirement savings. These contributions also reduce your taxable income, providing additional tax benefits.

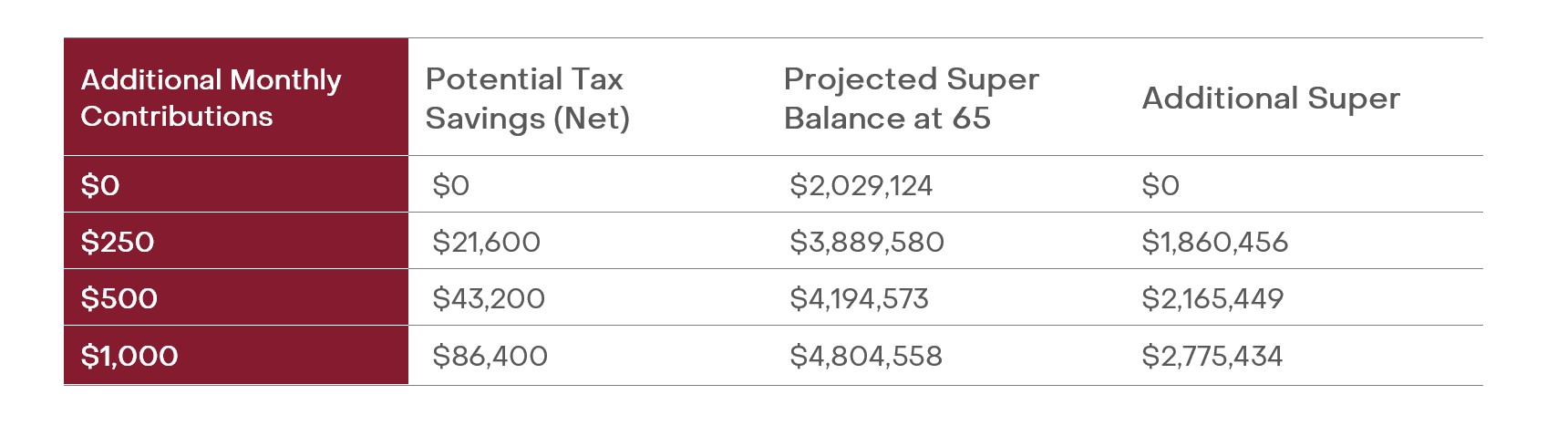

Consider the example of Elijah, who is 35 years old, has $250,000 saved in superannuation, and earns $150,000 per year (plus superannuation). Elijah is considering making additional contributions and wants to assess his options. If he continues on his current trajectory, his superannuation is projected to grow to over $2 million by retirement at age 65. By contributing an additional $250 per month, his balance is expected to nearly double to $3.89 million, while also generating net tax savings of $21,600 over the period.

If Elijah adopts a more aggressive strategy and contributes $1,000 monthly, he could save over $80,000 in tax and retire with an additional $2.7 million in superannuation.

Consideration: There are short-term (tax savings) and long-term (additional superannuation) benefits from making additional contributions to super. Small, regular deposits can compound meaningfully over time.

Source: E&P

Please note, the above table is for illustrative purposes only and does not constitute advice. The actual outcome will vary based on market movements, fees, insurance premiums, tax paid, and your relevant personal circumstances. The portfolio growth rate of 7% is based on the average 10-year return of a typical balanced portfolio as per Superratings. Individual performance may also differ due to timing of transactions or investment size of holdings.

Preparing for Division 296 changes: The growing importance of spouse splitting

Spouse contribution splitting is a strategy in which one spouse (the contributing spouse) transfers up to 85% of their superannuation contributions made in the previous financial year to their partner (the receiving spouse). You can now split contributions made in the financial year ending 30 June 2025. Traditionally, this strategy has been favoured by couples aiming to build the superannuation balance of one spouse to optimise tax outcomes (e.g. contributing more to the higher-earning spouse’s account) or to access funds earlier (e.g. contributing more to the older spouse’s account).

There is now additional merit in pursuing a spouse splitting strategy to equalise superannuation balances, particularly as the Government continues to advance the proposed Division 296 tax on super balances exceeding $3 million. While the Government estimates that 80,000 Australians will be impacted initially, this number is expected to grow, as the $3 million threshold is currently not proposed to be indexed. As illustrated in Elijah’s example above, many younger Australians may be affected by this tax in the future. Thus, early planning can help manage this risk over time. Please see here for our overview on the proposed Division 296 tax and here for further detail on spouse splitting.

Consideration: Assess your finances collectively as a couple. Where there are differences in super balance, age, or incomes, a spouse splitting strategy may be applicable.

Overview

The new financial year is an important time to form an updated financial strategy. While the Government’s increase in the Superannuation Guarantee will help Australians save more for retirement automatically, even small increases to this minimum contribution can make a significant difference to your retirement outcomes. Managing superannuation as a couple is now increasingly important due to the potential long-term implications associated with Division 296 tax. The tax savings available in the retirement phase of superannuation are also now more accessible due to the increased Transfer Balance Cap. An Evans and Partners financial adviser can provide personalised guidance on managing your superannuation and building wealth in a tax-effective manner.

Disclaimer

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information provided is correct at the time of writing and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained.

The information contains projections and forecasts (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. Neither E&P Financial Group and its related entities make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information. Results are only estimates, the actual amounts may be higher or lower. We cannot predict things that will affect your decision, such as changing interest rates. Seeking professional personal advice is highly recommended before acting on any such assumptions. Past performance is not a reliable indicator of future performance.

Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Tags

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.