The AI Revolution's Power Problem

We are potentially in the midst of the largest industrial revolution in human history. Artificial intelligence promises to redefine how we work and live, but there is one essential ingredient: electricity. How this is sourced is an essential question for investors.

A Trillion-Dollar Infrastructure Challenge

Trillions of dollars are expected to flow into AI infrastructure over the coming years. While estimates vary, the numbers are staggering. McKinsey estimates that by 2030, $6.7 trillion will be invested in data centre infrastructure, with $5.2 trillion for AI-capable facilities.

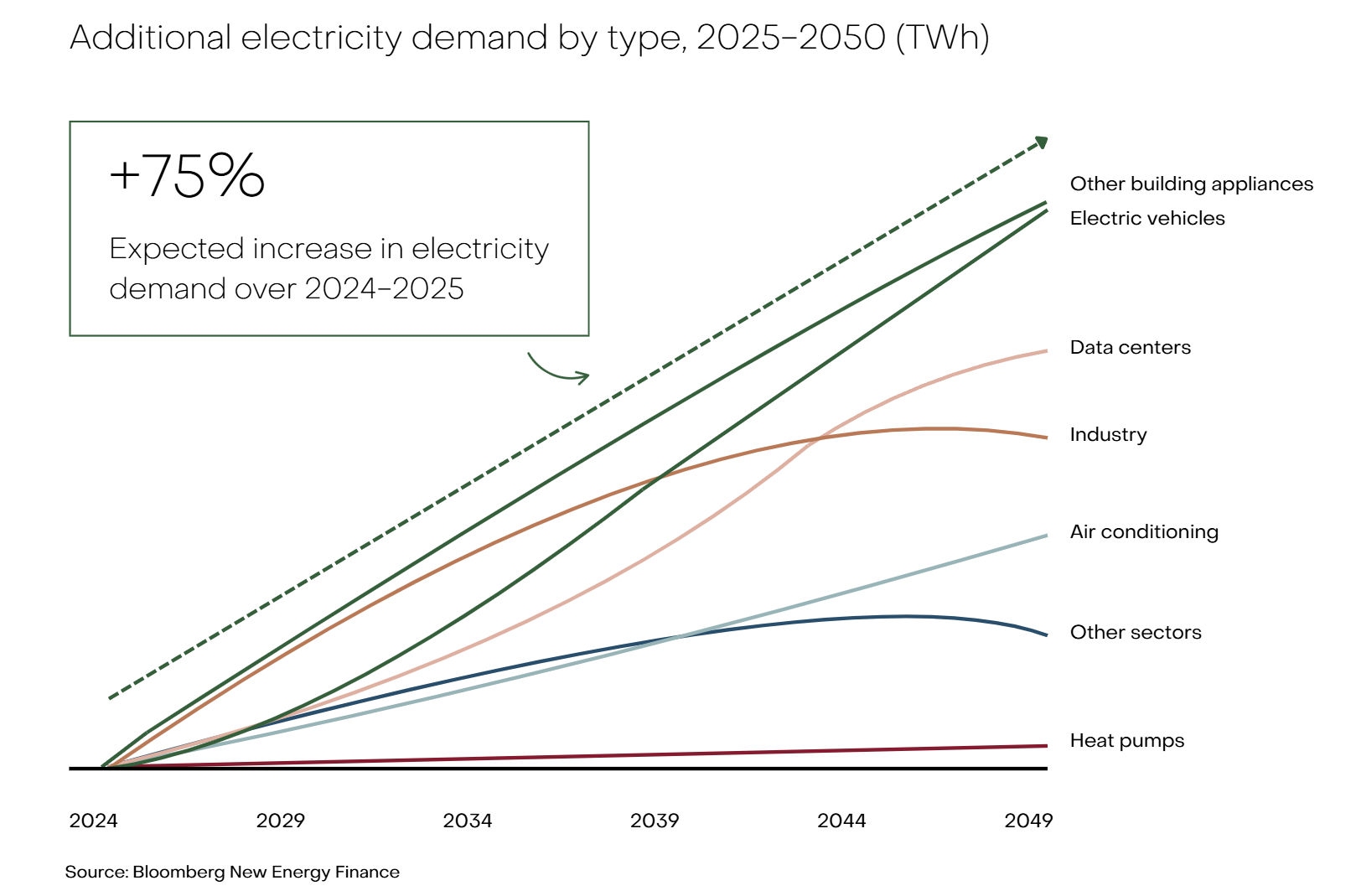

Today, data centres already consume approximately 2-3% of global electricity, expected to double within five years. In Ireland, data centres consume over 20% of national supply. The International Energy Agency projects data centre electricity use could equal Japan’s entire annual consumption by 2030, eqating to approximately 110 GW of continuous power.

This demand arrives as decarbonisation efforts require the ‘electrification of everything’. This includes heating systems, industrial processes, and transportation networks. This is creating combined strain on generation and associated grids.

Can Supply Meet Demand?

Despite recent political rhetoric to the contrary, increases in power demand continues to be absorbed predominantly by renewable energy. Global gas capacity additions have averaged just 10 GW annually in recent years, while new nuclear capacity this year will total a modest 3–5 GW. By contrast, 700 GW of renewable capacity will be installed globally this year alone, producing more electricity annually than Japan consumes.

The challenge however is one of timing. AI infrastructure investment and development is happening now. Data centre developers cannot wait for gas plants or nuclear facilities to be permitted, financed, constructed, and commissioned, a process that typically spans a decade or more. Gas supply chains face additional constraints, with turbine manufacturing capacity already stretched and lead times extending to years for new orders.

Solar and renewable energy will likely fill the gap by necessity. Projects can be brought online within 18–24 months, aligning with AI deployment timelines. However, intermittency challenges will require complementary solutions: battery storage, operational flexibility within data centres to shift loads, grid interconnection, and likely intermittent fossil fuel-based flexible generation to manage supply gaps.

The Environmental Cost

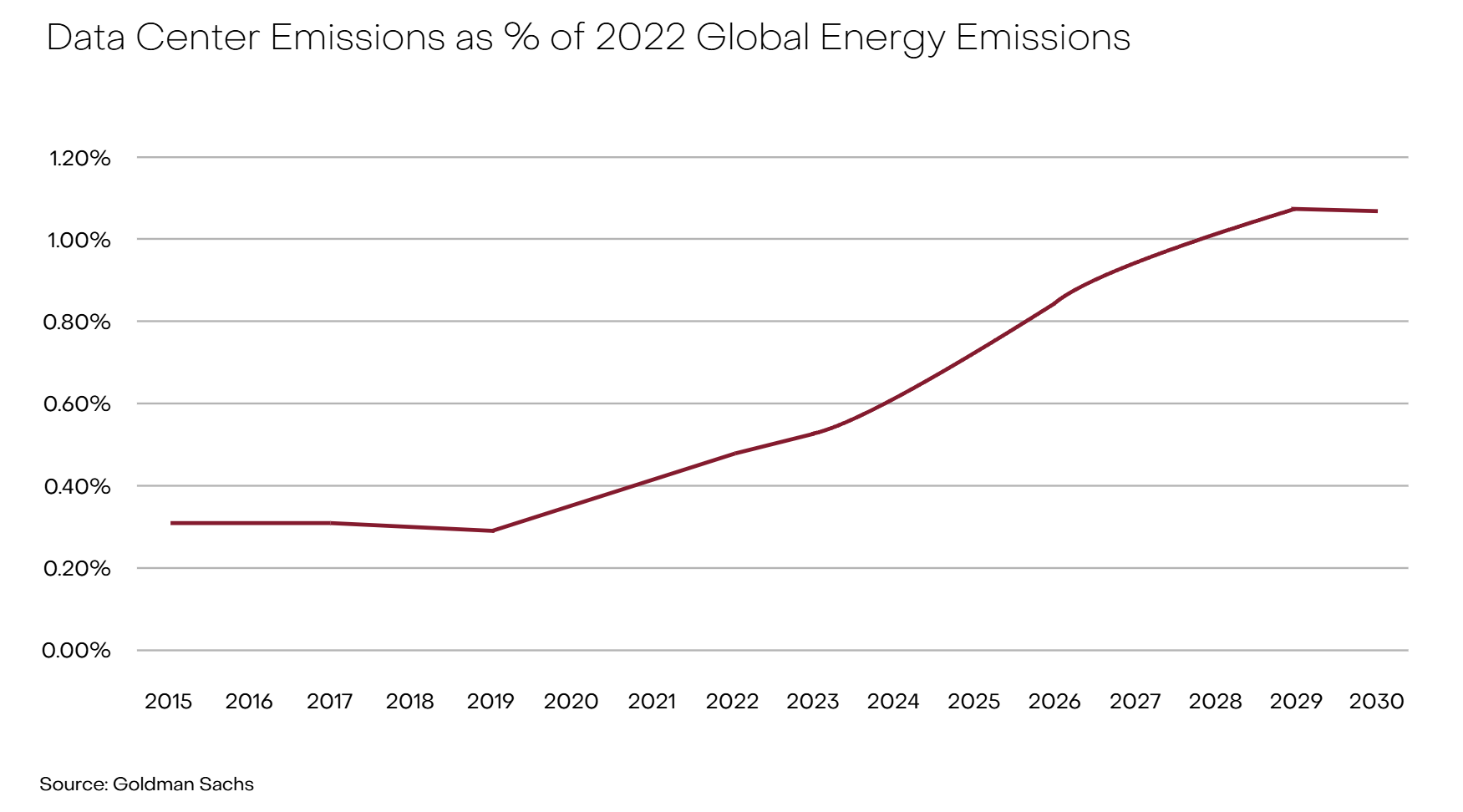

The AI boom looks likely to drive emissions in the wrong direction. The International Energy Agency projects data centre emissions will grow from 180 million tonnes of CO2 today to between 300 and 500 million tonnes by 2030-2035, depending on adoption rates and efficiency improvements.

Yet AI appears a double-edged sword. This same technology can optimise grid operations, improve renewable energy forecasting, and accelerate decarbonisation efforts.

The World Economic Forum suggests AI could help mitigate 5-10% of global emissions by 2030 through improved energy management and system efficiency.

Real-world deployment, however, tells a more complex story. In 2024, Elon Musk’s xAI data centre in Memphis installed 35 gas turbines without environmental permits. Optical gas imaging revealed visible pollution plumes, including unburned methane, drifting beyond facility boundaries.

Water withdrawal also presents an additional constraint. Research at the University of California suggests AI cooling could withdraw 4.2 to 6.6 billion cubic metres annually by 2027 – more than half the United Kingdom’s total consumption.

Investment Opportunities

AI and electrification are driving unprecedented demand for grid infrastructure upgrades. Renewable energy developers, energy storage providers, and grid modernisation companies are positioned to benefit – the question is which can deploy at scale while managing environmental and social risks effectively.

Disclaimer

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate. This communication is not intended to be a research report (as defined in ASIC Regulatory Guides 79 and 264). Any express or implicit opinion or recommendation about a named or readily identifiable investment product is merely a restatement, summary or extract of another research report that has already been broadly distributed. You may obtain a copy of the original research report from your adviser. The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance. The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. Neither E&P Financial Group, its related entities, officers, employees, agents, advisers nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information. The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge. The information provided is correct at the time of writing or recording and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained. Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

Tags

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.