The Economics of Artificial Intelligence

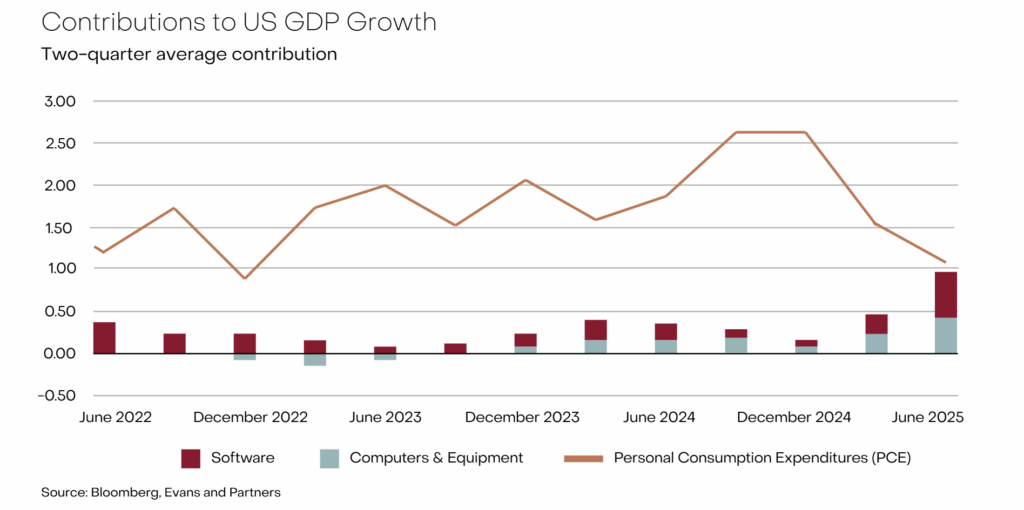

The US economy is experiencing something unprecedented: AI infrastructure spending is now contributing as much to US GDP growth as consumer spending. For Australian investors, this is enormously significant. The investment phase must eventually give way to an impact phase, and the timeline will shape global markets for the next decade.

A Historic Shift in GDP Composition

AI infrastructure spending is now contributing as much to US GDP growth as consumer spending. This is remarkable, given consumer spending represents roughly 70% of the American economy while AI infrastructure is a tiny fraction by comparison.

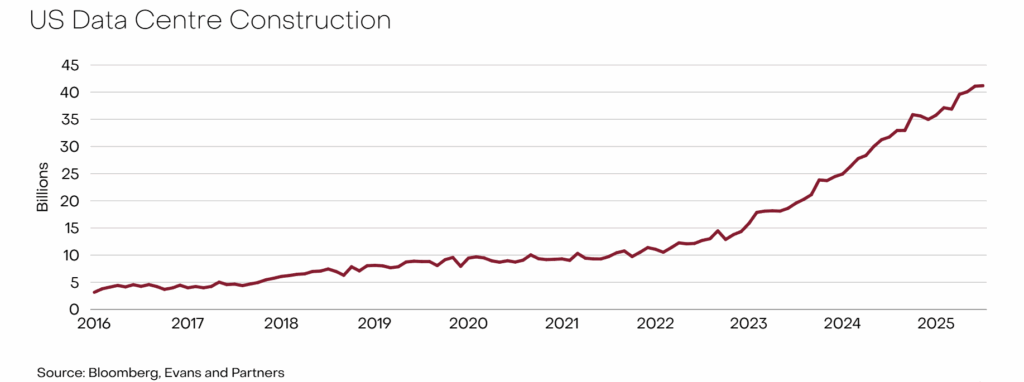

The scale of investment is staggering. The top 11 cloud providers are forecast to deploy $392 billion in 2025 alone, more than the previous two years combined. Just four companies (Amazon, Microsoft, Alphabet, and Meta) account for $315 billion of this AI infrastructure spending. Add Oracle’s massive cloud deals and Tesla’s AI infrastructure buildout, and the capital deployment becomes so enormous it’s reshaping the composition of US economic growth itself.

Investment Phase, Not Impact Phase

The critical point is we’re measuring the investment, not the impact. Think of AI’s economic contribution today as construction spending. It boosts GDP through building activity, equipment purchases, and employment. But construction spending isn’t the same as the economic value of the completed building.

Right now, AI is contributing to growth through capital deployment. The actual productivity gains that justify this spending remain largely ahead of us. Goldman Sachs research found no discernible impact yet on aggregate productivity measures. Enterprise AI initiatives currently achieve just 5.9% ROI against 10% capital investment. The gap between spending and economic returns is wide.

We’ve seen this pattern before. During the internet boom, companies invested over $500 billion in just five years, yet IT spending initially created a “productivity J-curve.” The investments made in the 1980s didn’t translate into economy-wide gains until the late 1990s — more than a decade later.

Risks if the Transition Stalls

Several factors could delay or diminish the transition from investment to impact:

Power constraints:

Even if all planned energy plants are delivered on time, the US could face a capacity deficit exceeding 15 gigawatts by 2030.

Slow adoption:

While nearly all companies are investing in AI, only 1% call themselves “mature” in deployment.

Labour market displacement:

Entry-level workers in AI-exposed occupations experienced 6% employment declines. By 2030, up to 30% of hours worked could be automated, requiring 12 million occupational transitions. If displaced workers face extended unemployment, consumption could weaken precisely when the economy is becoming more reliant on AI investment to maintain growth.

The Long-Term Prize

Yet if the transition succeeds, the economic transformation extends well beyond productivity statistics. Projections suggest AI will increase productivity by 1.5% by 2035 and nearly 3% by 2055, with 170 million new jobs created by 2030 alongside displacement.

More profoundly, AI promises to drive down costs and improve access to essential goods and services. In pharmaceuticals, AI could generate $60 billion to $110 billion annually in economic value by accelerating drug discovery, making life-saving medications cheaper and more accessible. These cost reductions could extend across healthcare, education, legal services, and professional services, effectively lowering inflation in sectors that have historically outpaced general price growth.

The result would be improved living standards through both higher productivity and greater accessibility to essential services, benefits that traditional GDP measures struggle to fully capture. The investment phase is real and quantifiable today. The impact phase, with its productivity gains, cost deflation, and improved access to critical services, remains a forecast extending into the 2030s. For global investors, successfully navigating this transition will define portfolio positioning for the next decade.

Disclaimer

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate. This communication is not intended to be a research report (as defined in ASIC Regulatory Guides 79 and 264). Any express or implicit opinion or recommendation about a named or readily identifiable investment product is merely a restatement, summary or extract of another research report that has already been broadly distributed. You may obtain a copy of the original research report from your adviser. The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance. The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. Neither E&P Financial Group, its related entities, officers, employees, agents, advisers nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information. The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge. The information provided is correct at the time of writing or recording and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained. Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

Tags

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.