The Next Phase of ESG: Divestment or Engagement?

The debate over how to handle companies with poor Environmental, Social, and Governance (ESG) performance divides investors. Should investors divest—selling stakes in firms failing ESG standards—or engage, using influence to drive improvements? This question, central to responsible investing, remains difficult to resolve. But there is increasing evidence that leaning towards engagement, or focusing on those companies that show meaningful improvement in ESG performance can be a strategy that delivers both financial returns and promotes change.

Unintended Consequences

Divestment involves selling stakes in companies with poor ESG records to reduce risk and signal ethical priorities. However, it can lead to unintended consequences, such as firms delisting from public markets or obscuring ESG data, reducing transparency.

As an example, private equity ESG disclosure at both a firm and company level are often lower than increasingly comprehensive public market requirements¹, creating a transparency gap as companies migrate away from public scrutiny. Divestment also limits investor influence, given they lose a seat at the table, leaving systemic issues unaddressed.

Engagement involves staying invested and using shareholder activism, proxy voting, or dialogue to push for ESG improvements. This approach recognises that many firms with poor ESG records can improve, especially under market pressure. Engagement fosters transparency, as companies are incentivised to disclose progress to attract ESG-focused capital.

The Financial Case for ESG Improvement

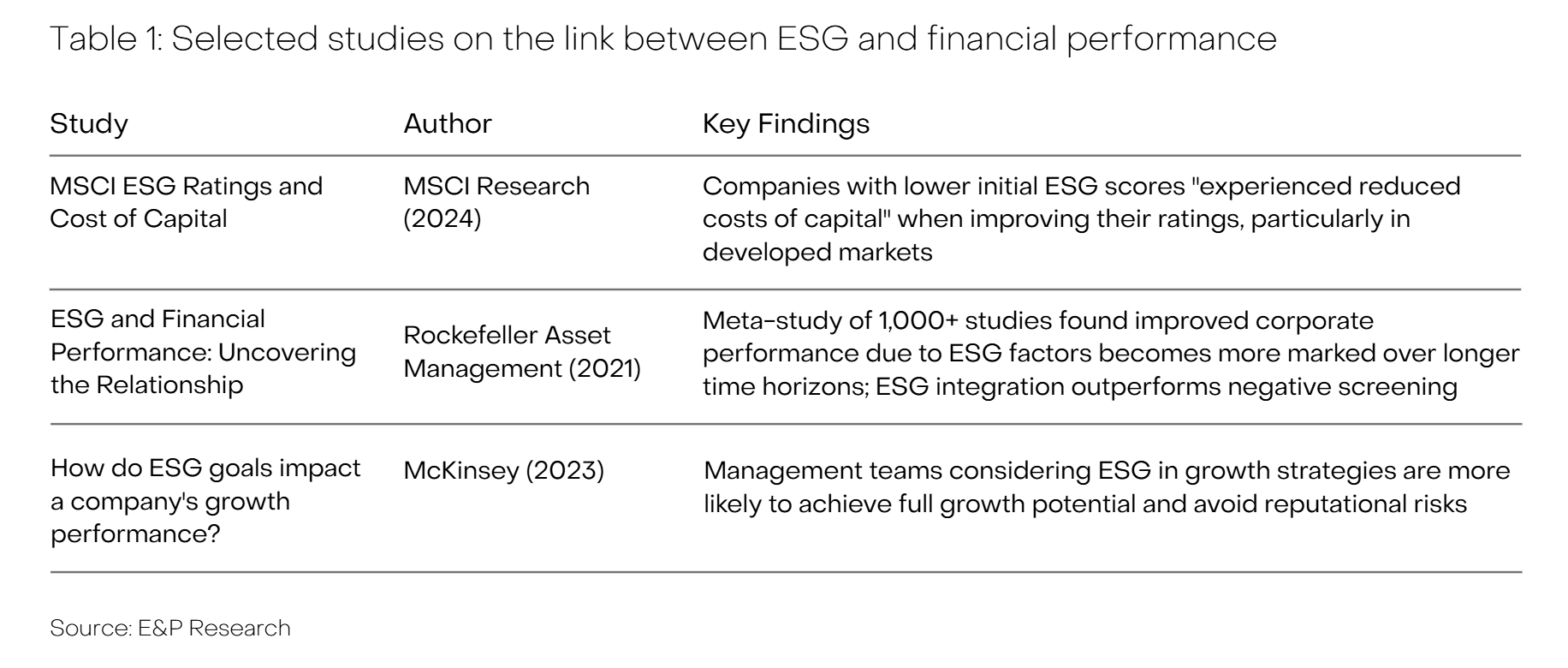

Empirical evidence appears to increasingly support ESG improvement over exclusion. While admittedly, academic studies vary in quality, the logic is sound. Companies that evolve business operations are likely to capture new market opportunities by shifting from legacy industries to emerging growth sectors, may use resources more efficiently which lowers operational costs, and/or subsequently benefit from a market re-rating as investors recognise reduced business risks and lower cost of capital.

Traditional Industries May Be Crucial Enablers

Climate change and other large-scale environmental and social problems are also too large for any single government, company, or investor to solve alone. As an example, the energy transition will require massive investment—with estimates ranging widely but consistently reaching ten-to-hundreds of trillions of dollars through 2050. This scale necessitates bringing along all industries, not just green leaders. It is important to acknowledge traditional energy firms possess critical assets and capabilities, such as existing pipeline networks suitable for alternative fuel transport, offshore platforms that may be repurposed for wind development, or the drilling expertise necessary for geothermal projects. The concept of ‘just transition’—ensuring fair treatment and retraining of workers in declining industries —should also not be forgotten. Rather than abandoning entire sectors, engagement can drive workforce development programs while accelerating the shift to sustainable alternatives.

ESG is Here to Evolve

Focusing on ESG improvement presents both opportunities and challenges. While financially attractive, it shouldn’t be an excuse to enable delay. Companies must demonstrate clear objectives with specific timelines, backed by committed capital expenditure and operational changes. Without these concrete commitments, ‘improvement’ rhetoric becomes meaningless green (or rainbow) washing. When done correctly—with rigorous due diligence, measurable targets, and ongoing accountability—a focus on improving companies can drive meaningful change while generating returns. The approach won’t always be perfect, but it may be more effective than walking away.

Notes:

¹ Pascal, Hendrikse, and Joos. “ESG Transparency of Private Equity and Debt Firms.” (2022) – Review of 3,765 PE firms globally using Preqin data.

Disclaimer

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate. This communication is not intended to be a research report (as defined in ASIC Regulatory Guides 79 and 264). Any express or implicit opinion or recommendation about a named or readily identifiable investment product is merely a restatement, summary or extract of another research report that has already been broadly distributed. You may obtain a copy of the original research report from your adviser. The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance. The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. Neither E&P Financial Group, its related entities, officers, employees, agents, advisers nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information. The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Tags

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.