Why Structured Giving Amplifies Your Impact

Australians are among the most generous people in the world, with close to three in five adults donating each year. Yet many of these gifts are made in an ad-hoc way, responding to appeals or giving when prompted by a cause. While meaningful, this style of giving can limit the long-term impact of your philanthropic capital. Structured giving provides a way to elevate that generosity, transforming one-off donations into a deliberate, enduring impact that compounds over time.

What is structured giving?

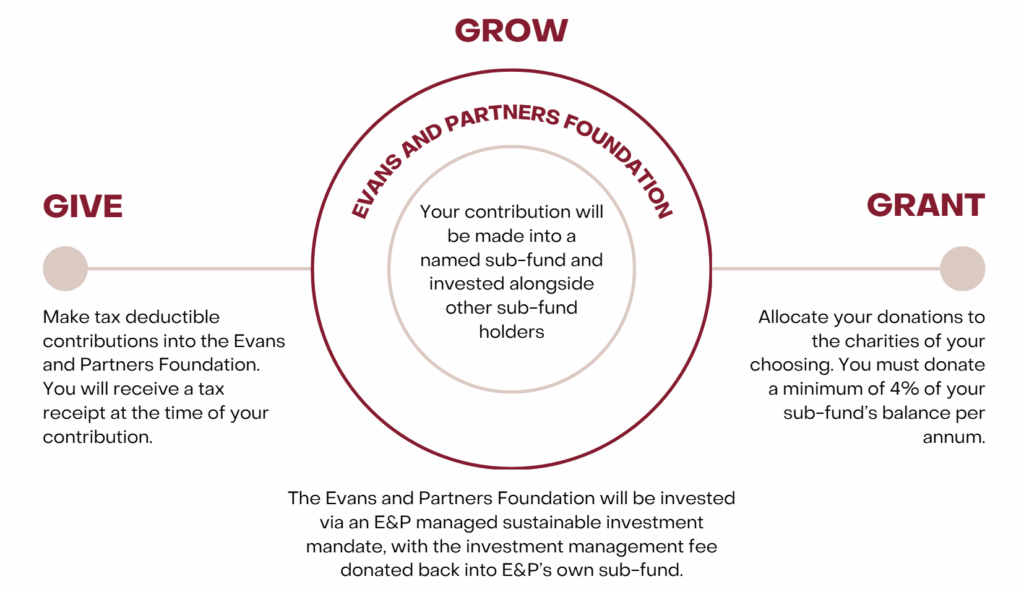

Structured giving means establishing a dedicated pool of capital for your philanthropy. As a donor, you contribute into a fund designed for long-term giving. You receive a tax-deduction upon contributing to the fund, the capital is invested, and the earnings are distributed to the charities of your choosing. Importantly, you retain flexibility over how, when and to whom you give to.

In Australia, there are two primary structures: Private Ancillary Funds (PAFs) and Public Ancillary Funds (PuAFs). PAFs are suitable for larger balances (typically $2 million+), allowing for full control over the investment portfolio, but carry more significant administration and audit requirements. A PuAF, by contrast, pools administration and investment management across many donors, making structured giving accessible with smaller entry points.

The Evans and Partners Foundation is a PuAF designed to make philanthropy more accessible. With a minimum of $20,000, you can establish your own account in yours or your family’s name (i.e., a named sub-fund). Your contributions are fully tax-deductible at the time they are made and are invested in an Evans and Partners managed portfolio, with sustainable investment overlays. Each year you must grant at least 4% of your balance to the charities of your choice.

Why structure your giving?

A common question offered asked by those considering structured giving vehicles is: “Why not just give directly?”

While every donor is different and has unique objectives, some of the common reasons people establish structured giving vehicles are:

- Compounding impact: Direct donations provide a one-off benefit to the charity of your choosing. Within a sub-fund, your capital is invested and continues working and growing in a tax-effective environment. This means that while you continue to support the causes you care about now, you are also building capacity to give more in the future.

- Flexibility in timing: Contributions to the Foundation are tax deductible in the year they are made, but you do not need to decide immediately what charities to support. This is particularly important for those who want to use philanthropy as part of a tax management strategy. After a large liquidity event it is imperative you obtain the tax deduction in that financial year, however you may not know what causes you wish to make a large gift to. Contributing to a structured giving vehicle allows you to secure the tax benefit now, while giving you time to consider which causes to support and how to involve your family in those decisions.

- Control and legacy: A sub-fund lets you be intentional with your giving. You can decide when to grant, which causes to support, and how to involve your family. Many donors use their sub-fund as a tool for intergenerational education, engaging children and grandchildren in values-based conversations. The fund can continue beyond your lifetime, allowing your next generations to carry your legacy forward.

How it works in practice

Consider Emma, a successful professional at the top tax rate of 47%. She wants to commit $150,000 to support medical research.

- Option A: Direct gift

Emma donates $150,000 today. The charity receives the funds in full, and she receives an immediate tax deduction worth $70,500. After her tax deduction Emma’s net contribution is $79,500. While impactful, the gift is complete once made, there is no further flexibility or compounding effect. - Option B: Sub-fund contribution

Emma contributes $150,000 into her own sub-fund. She still receives the same immediate tax deduction of $70,500, meaning after her tax deduction her net contribution is still $79,500. Emma can commence supporting the same medical research charities immediately, however the remainder of her funds are invested and can grow, to multiply her impact over time.

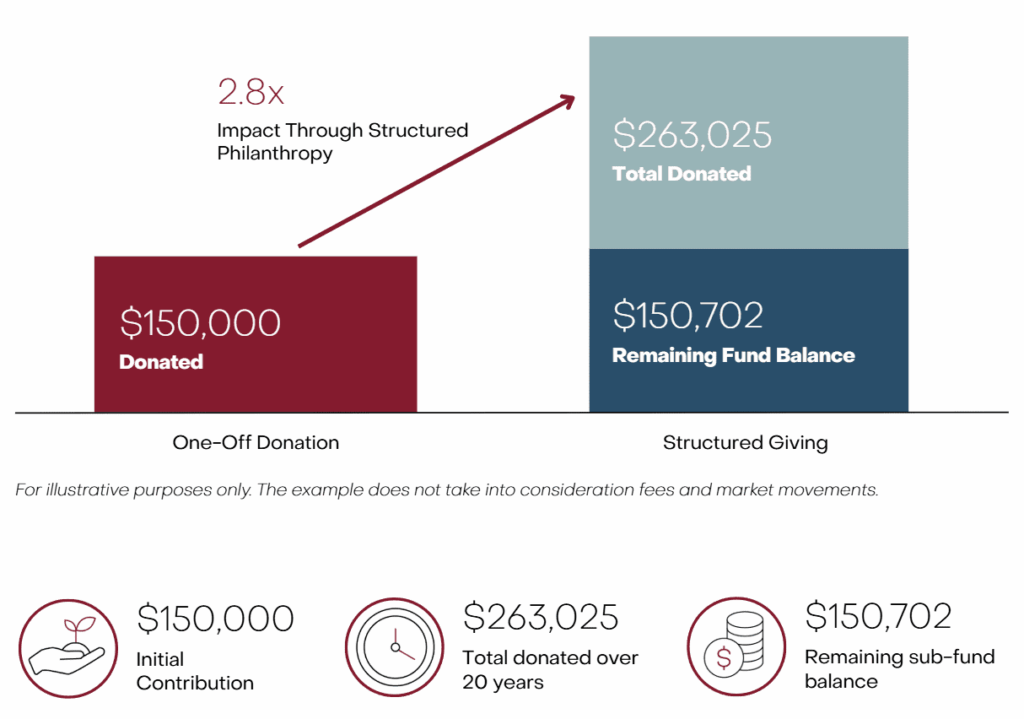

Over 20 years, assuming a 7% return and distributing 4% annually, Emma’s sub-fund provides more than her original $150,000 contribution in donations to charity while still retaining over $260,000 invested for future giving. In total, her philanthropy delivers more than $410,000 of impact, five times her original $79,500 net outlay after tax. The structure also allows her fund to continue beyond her lifetime, carrying forward her name, values, and legacy.

The power of structured giving

$150,000 initial contribution – 20 year comparison

The role of your adviser

Philanthropy is deeply personal. An Evans and Partners adviser can help you:

- Design your structure: Determine whether a sub-fund is right for you, and how it fits into your broader financial plan.

- Maximise tax efficiency: Ensure contributions are timed to reduce your tax obligations and align with your overall financial plan.

- Align giving with values: Identify the causes most meaningful to you and structure grants accordingly.

- Engage your family: Use the sub-fund as a platform for shared decision-making and legacy planning.

Disclaimer

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate. The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information. The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Tags

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.