Bumps on the Road to Decarbonisation

After challenging recent conditions, positive sentiment is returning to many sustainable sectors. Pleasingly, this sentiment is built on robust industry dynamics and looks to be a solid foundation for long-term structural growth.

In recent years, investors have been drawn to decarbonisation and broader environmental themes in public equity markets. Commonly targeted sectors have included renewable energy, electric transportation, water treatment, recycling infrastructure, green building and food alternatives.

Past challenges

Initially, many of these themes performed well. With investor imagination buoyed as the globe committed to ambitious ‘net zero’ emissions targets, capital to these sectors readily flowed. However, more recently, they have faced challenges. Rising interest rates and supply chain disruptions impacted margins, new themes such as artificial intelligence captured investor attention and enthusiasm for loss-making businesses waned.

Improving dynamics

While difficult to generalise (given the broad set of industries involved), several factors show that industry dynamics are now improving. Interest rate and supply chain issues are normalising, companies have adapted business models to suit the new operating environment, policy is increasingly supportive and valuations look attractive versus longer-term averages. We also remain strong believers in the long-term structural growth story that underpins demand for environmental focused product solutions.

Themes with decade-long growth runways

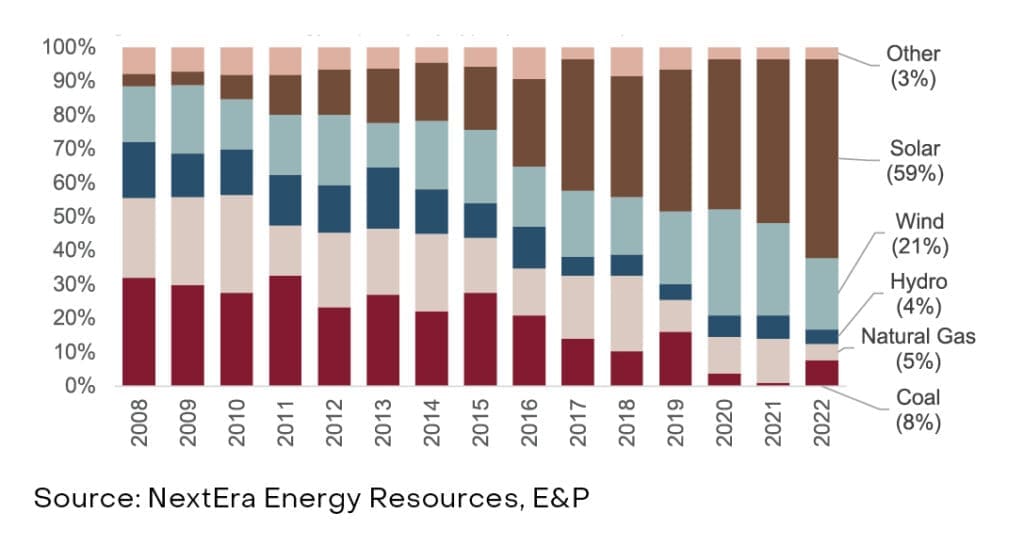

Renewable energy: Renewable energy is currently meeting 80% of new power demand globally. By 2030, renewables are expected to more than double their existing share of US energy consumption given industry trends leading to the ‘electrification of everything’.

Electric mobility: Globally, sales of electric vehicles (EVs) rose nearly 60% last year and, on that higher base, another jump of 30-35% is forecast for this year. By 2030, EV penetration rates are expected to reach 20%+ of total capacity as cost competitiveness is reached.

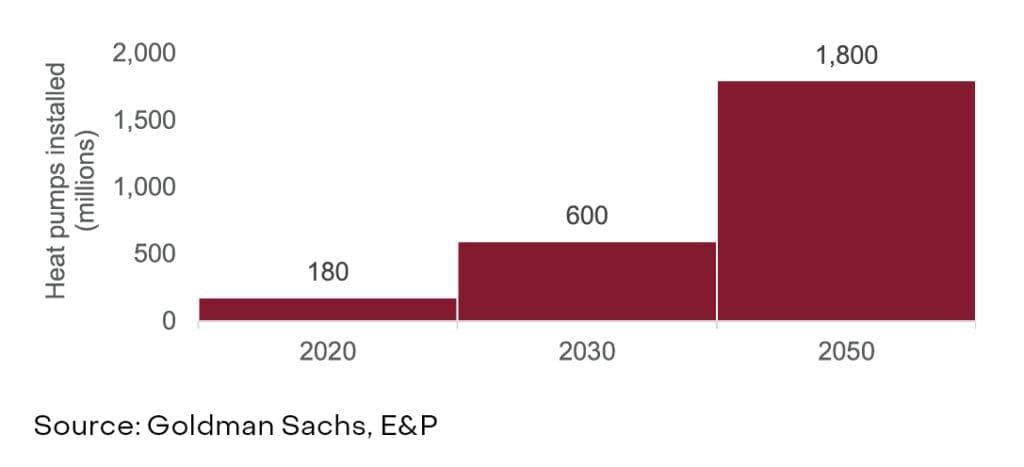

Energy efficient buildings: It is estimated that more than 75% of buildings in Europe are energy inefficient today and less than 10% of US commercial buildings comply with broad energy efficiency standards. To combat this, nations are increasing construction standards and retrofitting existing building stock.

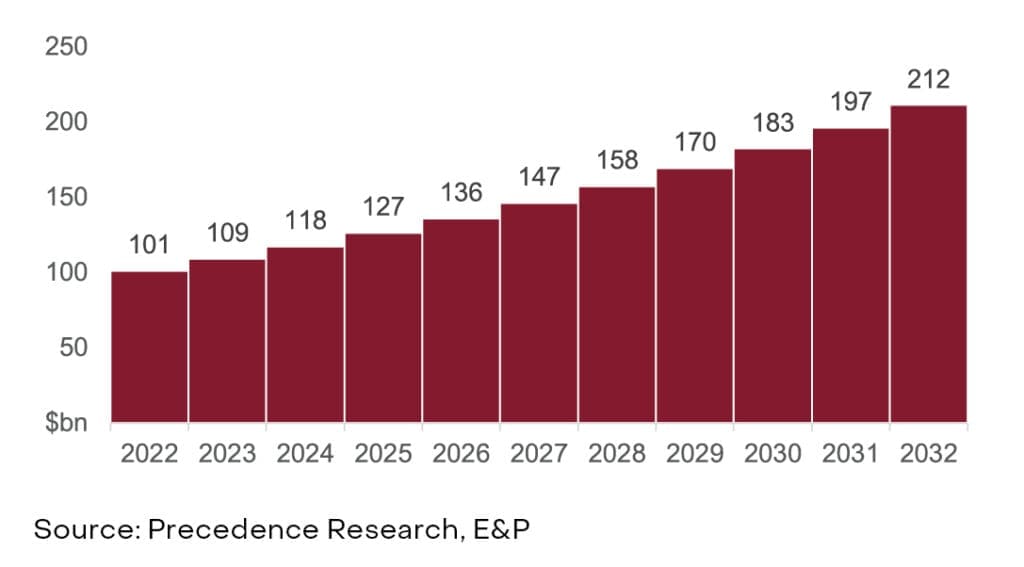

Industrial processes: Many of the chemical transformations that create steel, cement and plastic have a significant environmental footprint. Driven by consumer and government demands, current manufacturing and end-of-life processes are being changed to improve circularity. In steel production, electric arc furnace use with scrap metal is expected to increase to 50% of global production. In packaging, plastic is being replaced with sustainable alternatives.

Food production: Food production and consumption has an outsized impact on the environment – half of the world’s habitable land is used for agriculture. To help address this, innovative food and agriculture practices are gaining momentum. One area of growth is the realm of ‘specialty ingredients’ – food additives that enhance efficiency and overall quality.

Investible thematics

When allocating to these thematics we prefer to allocate via ‘active’ managers. Skilled managers should be better positioned to navigate the macro and market environment while also staying abreast of technological advancements and changing industry structures.

Percentage of global installed energy capacity by type (2008-2022)

Forecast number of heat pumps installed globally (2020-2050)

Potential market size for global sustainable packaging industry (2022-2032) (US billions)

Tags

Important Disclosures

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate.

The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

The information provided is correct at the time of writing or recording and is subject to change due to changes in legislation. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, there may be delays, omissions or inaccuracies in information contained.

Any taxation information contained in this communication is a general statement and should only be used as a guide. It does not constitute taxation advice and before making any decisions, you should seek professional taxation advice on any taxation matters where applicable.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.