Not-For-Profit Investing: Making Every Dollar Count

For most not-for-profits, fundraising is a natural focus, and rightly so. Philanthropy and grant funding are the lifeblood of service delivery and program growth. But one of the most underutilised sources of funding often sits in plain sight: the organisation’s own balance sheet. Whether it’s surplus operating cash, accumulated reserves, or a dedicated corpus, many not-for-profits hold meaningful capital that isn’t being put to work. When the appropriate strategy is implemented, thoughtful investing can create a dependable, untied, and mission-aligned stream of income.

Start with Your Objectives

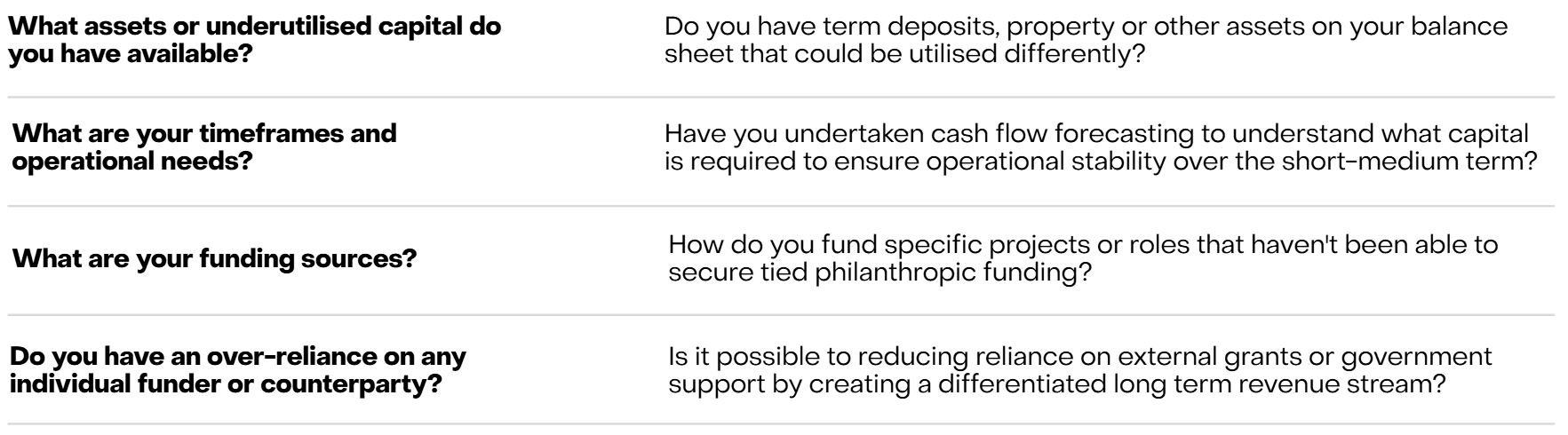

For those looking to get started, the first and most important step is articulating what you’re trying to achieve. Not-for-profit boards, executives and management teams should sit down and consider their organisation’s goals, and available capital sources. Example considerations might include:

These are strategic questions — not just financial ones — and they should guide how your capital is structured.

Aligning Capital to Purpose

Once objectives are clear, we often advise investors to consider dividing their investment capital into distinctive pools, each with a purpose directly linked to what the organisation is trying to achieve. As an example, the following is an investment strategy with three key components tied to organisational timeframes (short, medium and long-term):

Short-Term Investment Pool – Supporting Operations

This pool covers your near-term needs: paying staff, operating costs, and simply keeping the lights on. It is invested very defensively and prioritises capital preservation, income generation and liquidity. In today’s falling interest rate environment, it is especially important to review cash reserves given lower interest rates mean a lower return on cash. Squeezing every extra dollar out of capital can make a material difference to your operations.

Medium-Term Investment Pool – Funding What’s Next

Think of this as the bridge between now and the future. This pool supports known, upcoming priorities — such as hiring new staff, expanding service offerings, or upcoming building works. With a defined time horizon, this pool can tolerate some investment risk in pursuit of moderate returns, providing greater financial autonomy when new opportunities arise.

Long-Term Investment Pool – Creating Enduring Impact

This ‘long-term pool’ supports mission longevity — enabling a funding base that grows over time and can respond to evolving needs. With a longer time investment horizon, this capital is generally invested in growth assets with the aim of compounding over decades. Because this funding is effectively ‘untied’, it can be directed to wherever the need is greatest — supporting long-term sustainability, innovation, or new initiatives.

Building Stakeholder Confidence

Having clear governance and structure around your investment strategy serves more than just internal purposes — it’s also a powerful tool for building confidence with external stakeholders and funders. As an example, we have seen numerous not-for-profits successfully establish dedicated ‘endowment’ funds as part of their long-term investment pool strategy. These endowments not only generate sustainable income streams but also attract donors who want to contribute to the organisation’s perpetual mission rather than funding specific projects. When developing these frameworks, incorporating responsible and values-aligned investment overlays can also be equally important. It ensures your investment capital reflects your organisation’s mission, values, and meets stakeholder expectations — something that can be crucial when soliciting broad capital donations rather than project-specific funding.

How to Get Started

The best place to begin is with a conversation: review your organisational objectives, and explore how your capital could be better aligned to support them. By thinking differently — and more strategically — about your own balance sheet, you can unlock a powerful source of untied funding that complements your fundraising efforts and supports your mission, now and into the future.

Disclaimer

This document was prepared by Evans and Partners Pty Ltd (ABN 85 125 338 785, AFSL 318075) (“Evans and Partners”). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457) (E&P Financial Group) and related bodies corporate. The information may contain general advice or is factual information and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Before investing reserves, Responsible Persons must thoroughly review governing documents and understand all legal obligations. Where a particular financial product has been referred to, you should obtain a copy of the relevant product disclosure statement or other offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance. The information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. Neither E&P Financial Group, its related entities, officers, employees, agents, advisers nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate E&P Financial Group takes no responsibility in reliance upon this information. The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.eandp.com.au. Please let us know if you would like to receive a hard copy free of charge.

Tags

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.